Out Of The 3 Credit Bureaus Is Most Important – I have been in the credit repair industry for fifteen years and this is a question I get asked several times a week and sometimes several times a day.

Consumer: I checked my credit score online the other day and my score was fine, but when I went to the bank to apply for a loan, they said my score was much lower than I indicated. Why? what’s going on

Out Of The 3 Credit Bureaus Is Most Important

Well, I hate to be the bearer of bad news, but here’s the ugly truth about credit scores…When you think of credit scores, you probably think of a constant fixed number that you can count on, but wait ? Is that so? It depends on who calculates your score and how.

Consumer Credit Data

The three major credit bureaus determine individual consumer scores using mathematical algorithms. There are literally dozens of variations of this algorithm for determining credit scores. Most of you will never see, never understand. In fact, there can be hundreds of point changes on any given day thanks to Fair Isaac. created the most widely used scoring model (FICO Score) and also provided many algorithms that bureaus use to arrive at different conclusions based on their needs. In short, they can tweak the math to come up with whatever conclusion suits their needs, so different scores for financial purposes like home loans, auto loans, consumer loans, credit cards, etc… Honestly , there was more. more than fifty score versions are used in the market. So that’s a simplified explanation! Is that fair? I guess it depends on who you ask. The minimalist “why not just have one reliable score system, so there is one reliable score?” he asks. Perhaps this would be a good solution to all the confusion, and in fact the Consumer Financial Protection Bureau agrees. In 2011, they concluded that the score a consumer might get for themselves might not be the same as the score a creditor might get.

As a consumer advocate, I have known about this issue for a long time. I have been looking for ways for consumers to at least be prepared for such problems. What I advise my clients is not a 100 percent solution but a surprise prevention tool, I have found that a good credit monitoring system can help consumers stay on the same page when it comes to getting an accurate score on any given. The goal. On a side note, you get what you pay for and that’s why the word “Free” (as good as it sounds) isn’t a smart way to go (Credit Karma, etc.) these freebies often come with a price tag . I use my company’s internal monitoring system, which is available to any consumer, and have consistently found it to be accurate and up-to-date. Credit Score Key also has many other features to keep your scores at their best at all times.

The idea here is to be aware of your credit status on a daily basis and not be caught off guard if something new comes up that could affect your score. If you learn how to keep your credit in tip top shape, you can be successful no matter what scoring system is used.

If you have any questions or comments, please contact us at National Credit Resources (NCR) and we will be happy to help you achieve the credit scores you hope for.

A Secret Web Of Credit Reports Is Tracking Everything You Do

We take the guesswork out of the process and hopefully give you some very useful knowledge that will give you the edge you need to achieve the life you want! Most or all of the products listed here are from our partners who compensate us. This may affect which products we write about and where and how the product appears on the page. However, this does not affect our evaluations.

The main scoring models are FICO® and VantageScore®, both of which are equally accurate. While both are true, most lenders look at your FICO score when you apply for a loan.

There is a lot to learn about scores and reports, and multiple scores can be confusing. If you don’t know which score and report are most accurate, it can be difficult to know whether you qualify for a loan or your health status.

By understanding the different points, you can save time and improve your . Every time you apply for a loan, it can lower your score, so it’s best to know your score is correct before filling out applications.

Credit Card Debt Statistics

Here, you’ll learn about the different scoring models lenders use most often and how to properly check your score.

As the Consumer Financial Protection Bureau explains, “A report is a statement that contains information about your activity and current situation, such as your loan repayment history and the status of your accounts.”

Based on the information from your report, the bureaus will give you a three-digit score. The two main companies give you a score based on this data, but they weigh the data differently.

If the information on your report is correct, your score will be correct. If there’s an error on your report, your score may be incorrect, and you’ll need to ask for it to be removed or corrected.

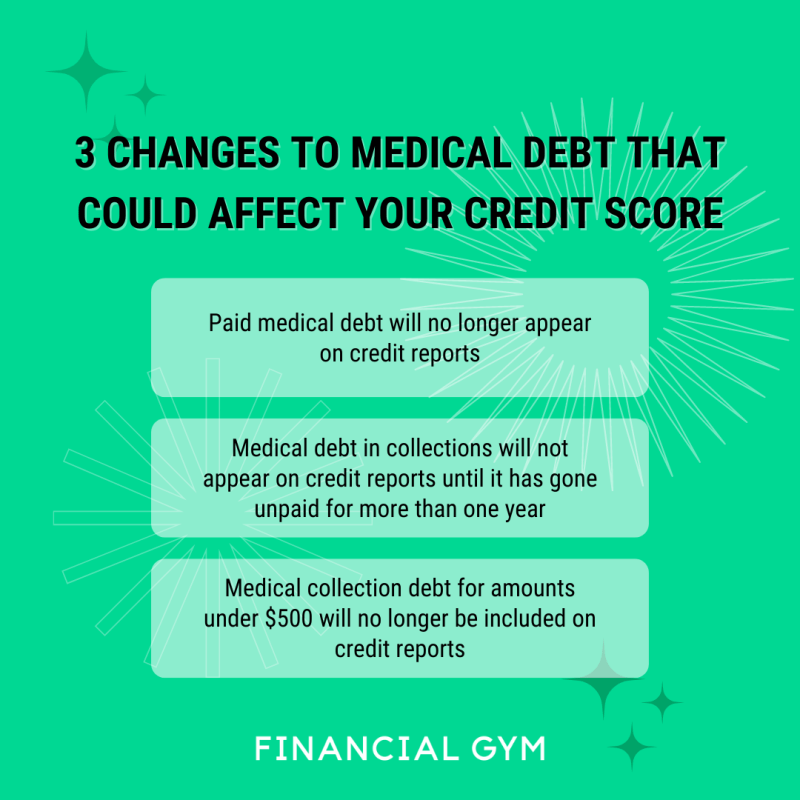

Most Medical Debt To Be Removed From Credit Reports

There are two main rating models and both can give you a different score. The main scoring model is through FICO, and another common scoring model is VantageScore. Next, we’ll break down both scoring models so you can better understand their similarities and differences.

FICO is a division of Fair Isaac, the original company that created scores to help lenders assess risk in the 1960s. Based on five indicators on your report, FICO gives you a score that lenders use to get an idea of how likely you are to repay the loan.

Below are the five factors FICO uses for its model and their weightings:

As you can see, the FICO model places a lot of importance on how well you make your payments on time. The second most important factor is what’s known as debt-to-equity or utilization, and it shows how much you owe compared to your total available. They are also looking at how much experience you have, what kind of experience you have, and how often you apply for new leads or loans.

What Is A Credit Score? Definition, Factors, And Ways To Raise It

VantageScore 3.0 is the current version of the VantageScore scoring model. Like FICO, VantageScore is a company that gives you a score based on criteria on your report. The three major bureaus, Equifax®, TransUnion®, and Experian®, have VantageScore, which was created in 2006 to give more people access to scores.

VantageScore also has a more comprehensive score than FICO, and it’s for balances. This is the total amount of your most recently reported debts, including past due balances.

Many people believe that the FICO score is more important to focus on. FICO states that most lenders prefer the FICO scoring model, and the FICO website indicates that 90 percent of lenders use their own scoring model.

In addition to the two main scoring models, you’ll find different scores at each bureau. Since Experian is the largest bureau, many people wonder how accurate the Experian rating is. As with scoring models, your score will be equally accurate with each individual bureau based on the information provided on your report for that bureau.

What Are Bankruptcy Friendly Credit Cards?

Now that you know your score should be accurate no matter where you check, there may be some reasons why your scores may be different. While small differences in your score may be completely normal, it could also be a problem that you should check for.

One of the best ways to ensure that your scores and report are as accurate as possible is to check both regularly.

The law gives you the right to a copy of your report free of charge under the Fair Reporting Act (FCRA). You can visit AnnualReport.com to get your free report.

You can check your score regularly, in a variety of ways, and it won’t hurt your score. Although hard inquiries can lower your score, according to the Consumer Financial Protection Bureau, monitoring allows you to view your score without damaging it.

What Are The 3 Credit Bureaus? Here’s What You Need To Know

You can check your score for free here. We also offer a free report card that gives you a more in-depth look at your health and what factors impact your score the most.

Many aspects of your financial life revolve around your score, so it pays to keep track of it as much as possible. Your score will determine how you get a loan

What credit score is most important, which credit score is the most important, family is the most important, which credit score bureau is the most important, which of the 3 credit bureaus is best, names of the credit bureaus, which credit report is most important, what is the most important credit score, out of the 3 credit bureaus is most important, address of the 3 credit bureaus, which of the 3 credit bureaus is most important, which of the 3 credit bureaus is most accurate