Energy Storage Solutions: How Batteries Can Help You Save On Electricity Costs – The market for battery energy storage systems is growing rapidly. Basic questions for those who want to visit Thel.

As the goals of the next phase of the Paris Agreement fast approach, governments and organizations are looking to increase the adoption of renewable energy sources. In some of the most energy-intensive regions, there is an additional incentive to seek alternatives to traditional energy. In Europe, the stimulus comes from the energy crisis. In the United States, the Inflation Reduction Act was passed in 2022 to allocate $370 billion to clean energy investments.

Energy Storage Solutions: How Batteries Can Help You Save On Electricity Costs

This article is a collaborative effort by Gabriella Yarbratt, Süren Jautelat, Martin Linder, Eric Spar, Alexander van de Rijt, and Quan Han Wong, reflecting the perspectives of the Industrial and Electronics Practice and Battery Acceleration Team.

Battery Energy Storage Solutions In 2022

These developments are driving the market for battery energy storage systems (BESS). Battery storage is a key opportunity for renewable energy production, and despite the interplay between primary sources, alternatives can help make a sustainable contribution to the world’s energy needs. The flexibility that BESS provides will make it integral to applications such as hair-cutting, self-consumption optimization, and backup power in the event of blackouts. These applications become more profitable as battery prices drop.

All this created a great opportunity. According to our analysis, more than $5 billion will be invested in BESS in 2022 – almost three times the amount of the previous year. We expect the global BESS market to reach $120 billion to $150 billion by 2030, more than double its size today. But it’s still a fragmented market, with many providers wondering where and how to compete. Now is the time to identify where the best opportunities lie in the rapidly accelerating BESS market and start preparing for them.

The best way to understand the opportunities associated with BESS is to segment the market by user application and size. BESS has three segments: front-of-the-meter (FTM) utility-scale installations, which are typically larger than ten megawatt-hours (MW); behind the meter (BTM) commercial and industrial installations, which typically range from 30 kilowatt-hours (kWh) to ten MW; and BTM residential installations, typically less than 30 kWh (Exhibit 1).

We expect utility-scale BESS, which accounts for the bulk of new annual capacity, to grow at about 29 percent per year over this decade—the fastest of the three segments. With an estimated 450 to 620 gigawatt-hours (GWh) of annual utility-scale installations by 2030, utility-scale BESS will account for up to 90 percent of the total market that year (Exhibit 2).

What Are The Benefits Of Battery Storage Systems?

FTM’s deployment customers are primarily utilities, grid operators, and renewable developers looking to balance renewable intermediation, provide grid stability services, or defer costly investments in their grid. BESS providers in this segment are typically vertically integrated battery manufacturers or large system integrators. They will differentiate themselves based on cost and scale, reliability, project management track record, grid optimization and ability to develop energy management systems and software solutions for the trade.

The deployment of BESS is on a massive scale. A US power company is working on the BESS project, which could eventually have six GW of capacity. Another U.S. company, with business interests in and outside of energy, has surpassed the target of 6.5 GWh in BESS installations by 2022. Most of the money currently invested in BESS is focused on services that increase the flexibility of energy suppliers, for example through fixed frequency. Soon, BESS growth will be more than just solar parks and wind farms, which will need batteries to meet short-term storage needs.

Revenue models for FTM utility-scale BESS are highly dependent on the dynamics of the regions in which providers operate. Many utility-scale BESS players are pursuing a strategy of pooling revenue, or collecting revenue from multiple sources. They can participate in ancillary services, arbitration, potential auctions. For example, many BESS installations in the UK now revolve around ancillary services such as frequency control. In Italy, there are BESS players who have won the country’s renewable potential auctions. Opportunities in Germany avoid costly network upgrades. BESS players involved in the FTM utility segment have realized the value of responding individually to countries and their regulations using a single monolithic strategy.

Commercial and industrial (C&I) is the second largest segment, and we forecast a 13 percent CAGR for C&I to reach 52-70 GWh in annual additions by 2030.

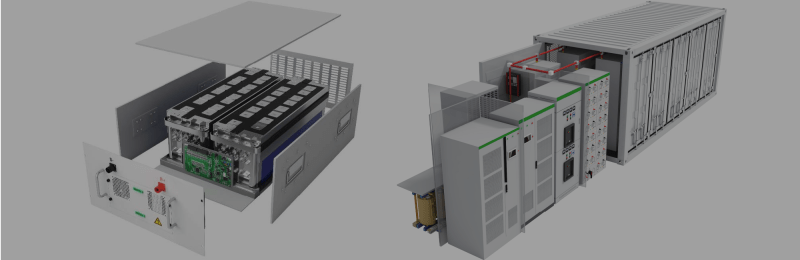

Battery Storage Power Station

C&I has four divisions. The first is Electric Vehicle Charging Infrastructure (EVCI). According to the Center for Future Mobility, it will jump from 23 percent of global auto sales in 2025 to 45 percent in 2030. This growth will require a rapid expansion of regular charging stations and superchargers, stressing existing grid infrastructure and requiring expensive, time-consuming upgrades. To avoid this, charging station companies and owners can install a BESS on their property. Partnerships have been formed between EV players and EV manufacturers to build more EVCIs, including in remote areas.

The next part of C&I is critical infrastructure like telecommunication towers, data centers and hospitals. In this subdivision, lead acid batteries typically provide temporary backup through an uninterruptible power supply during outages until the electric CV or diesel generators are fired up. In addition to replacing lead-acid batteries, lithium-ion BESS products can also be used to reduce reliance on less environmentally friendly diesel generators and can be integrated with renewable sources such as rooftop solar. In some cases, excess energy stored in batteries allows organizations to generate revenue through grid services. Several telecom players and data center owners are switching to BESS for their uninterruptible power supply solution and the added benefits BESS offers.

The third section is public infrastructure, commercial buildings and factories. This division will primarily use energy storage systems, shearing, integration with on-site renewables, self-consumption optimization, backup applications and network services. We believe BESS can reduce energy costs in these areas by up to 80 percent. The argument for BESS is particularly strong in places like Germany, North America, and the United Kingdom where demand charges are used.

The latter C&I division consists of a complex environment – mining, construction, oil and gas exploration applications, and activities such as outdoor festivals. The source of growth is customers switching from diesel or gas generators in favor of low-emission solutions such as BESS and hybrid generators. A key driver of adoption in this segment is upcoming regulations (including the European Commission’s sustainability-focused Big Buyers Initiative and Oslo’s 2025 net zero plan on construction sites). Most generator companies will start by transitioning to hybrid genset solutions instead of switching to BESS immediately.

Battery Energy Storage Systems Are The Answer To The Challenges In The Electricity Market

Residential installations represent the smallest BESS segment at around 20 GWh in 2030. But residential is an interesting segment with opportunities for innovation and differentiation, from traditional home storage to microgrids in remote communities. From a sales perspective, BESS can be connected to photovoltaic panels or integrated into smart homes or home EV charging systems. Specialty products will help residential customers achieve goals such as self-sufficiency, optimal self-consumption, and low energy consumption, and they may mean higher rankings in the industry. A survey of end-users on alternative energy purchases shows that interest in a BESS product will come down to a number of factors, starting with cost, safety and ease of installation (Exhibit 3).

In such a new market, it is important to understand the potential revenue and margins associated with different products and services. The BESS value chain starts with manufacturers of storage components, including battery cells and packs, and inverters, housings and other critical components in the balance of systems. According to our estimates, the providers in this part of the chain will receive approximately half of the BESS market profit pool.

Then there are system integration activities, including the overall design and development of energy management systems and other software to make BESS more flexible and useful. We expect these integrators to capture another 25-30 percent of the profit pool.

Finally, 10 to 20 percent of the profit pool is associated with sales entities, project development organizations, and customer acquisition and operation (Exhibit 4).

Xcel Energy To Build Multi Day Battery Storage Project Using Form Energy’s Iron Air Batteries

From a technology perspective, the key battery metrics for customers are cycle life and affordability. Lithium-ion batteries are currently dominant because they meet the needs of customers. Nickel manganese cobalt cathode was the main battery chemistry, but lithium iron phosphate (LFP) has overtaken it as a cheaper option. .

How to save on energy costs, how to save on electricity costs, how can you save energy, how to save money on energy costs, save on energy costs, save electricity costs, how to save on electricity, electricity storage batteries, how to save energy costs, save on electricity costs, help with electricity costs, how to save electricity energy