What Is The Purpose Of Life Insurance – For many people, especially those with young families, their biggest asset is probably their ability to earn money in the future. This makes life insurance one of the most important parts of their budget. We insure our house against fire and flood and our cars against collision, so why shouldn’t we insure our greatest asset? It usually comes down to there being too many decisions to make and too few objective partners to provide free advice. So, if you can’t figure out how much benefit you need, what kind and for how long: this series will be a great place to start.

The purpose of life insurance is very simple; it’s to replace your income with your dependents after you retire. Life insurance is a contract between you and the insurance company. You pay premiums for a defined period and the insurance company promises to pay a death benefit to your beneficiary if you die while the policy is active. Beware, if you don’t pay the premiums, the insurance company may not be obligated to pay the death benefit!

What Is The Purpose Of Life Insurance

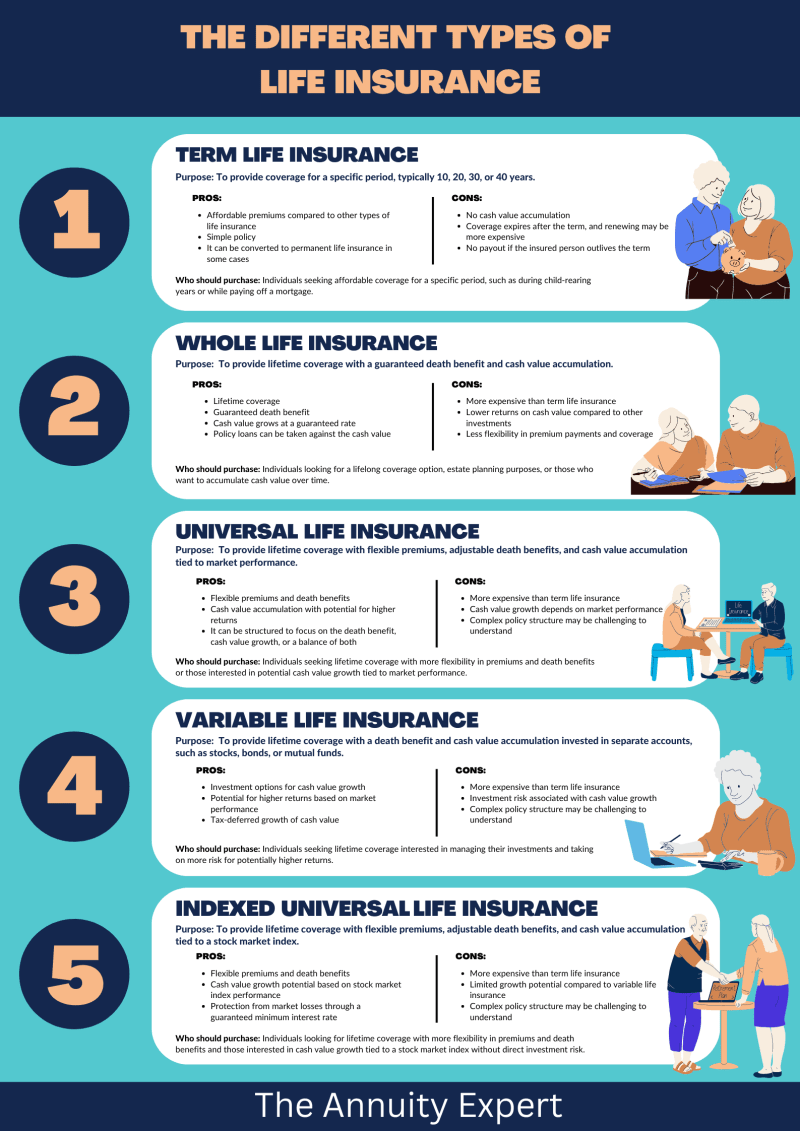

One of the hardest things to figure out with life insurance is what coverage you need because there are so many options! The following types of life insurance are the most common policies offered.

Alabama Life Insurance Exam

Term insurance is the simplest and cheapest life insurance. The term is a fixed period of time, say 10 or 20 years, during which you pay your premiums in exchange for a death benefit. If you die within the period, the insurance company pays the death benefit to your beneficiary, if you do not die within the period, the policy expires. A good way to think about life insurance is to compare it to your car insurance. You pay premiums for your car insurance if you get into an accident. If you don’t have an accident, you won’t get the premiums back. This concept is the same for life insurance. Yes, you will never get the benefit of this policy if it expires. But hey, at least you’re alive! Some good examples of when life insurance makes sense are for temporary needs such as:

Permanent insurance, which is much more complex than term insurance, can act not only as an insurance expense but also as an asset. The main difference from term insurance is that permanent insurance has a “fund value” component and the death benefit does not expire. While premiums are necessary for the rest of your life, the cash value can help offset some or all of these insurance costs if it has enough time to accumulate. Some examples of when permanent life insurance makes sense are when there are permanent needs such as:

There are various types of permanent life insurance to consider; whole life, universal life, and variable universal life insurance.

Whole life insurance is considered “original” permanent life insurance since the policy is there for your entire life. Premiums for whole life insurance are fixed for the entire policy term, so while they are paid, they do not increase as you age. When you pay premiums on your whole life insurance, a portion goes to cover the actual cost of insurance and a portion goes to the cash savings portion. This can explain the cost difference when compared to term insurance!

Solved Which Of The Following Statements About The Grace

Universal life insurance is very similar to Whole Life except that your premiums and death benefits can be more flexible and you can change them if you need to. When you adjust your premiums, you are essentially using some of your cash value to lower your payment. If an unexpected financial need arises, you can temporarily stop premium payments and make up the difference later when things are back to normal.

This is where we start to see a lot more complexity because in addition to the insurance part and the savings part, variable comprehensive life allows for

To decide how your cash value is invested. While this may seem like a bonus, the investment risk is now entirely on you, not the insurance company.

Everyone’s life insurance needs are different, so don’t hesitate to contact us if you have any questions about how life insurance could be part of your financial plan. This information is not intended to replace specific individualized advice and we recommend that you discuss your specific circumstances with a qualified financial advisor. Two of the most common types of life insurance are term life insurance and term life insurance. Whole life is permanent life insurance that lasts as long as you live (assuming you pay the premiums for the policy). It also includes a cash value account – a type of savings account that grows tax-free over time and that you can withdraw or borrow from while you’re alive. Term life insurance, on the other hand, only lasts for a certain number of years (the term) and does not accumulate any cash. If you’re not sure where to buy these policies, you can choose either term or whole life insurance from one of these top life insurance companies.

Introduction To Life Insurance

Life insurance is perhaps the easiest to understand because it is simple insurance, with no savings or investment component. The reason you buy term insurance is because of the promise of a death benefit for your beneficiary if you die while it’s in force. For many, it’s a way to make sure their minor children are supported and their mortgages are paid after they die.

As the name suggests, this basic form of insurance is only good for a certain period of time, be it five, 20 or 30 years. After that, the policy expires.

Because term insurance offers basic coverage for a limited period of time, they tend to be the cheapest type of life insurance, often by a wide margin. If all you’re looking for from a life insurance policy is the ability to protect your family when you die, then term insurance is probably best.

Since term insurance is usually more affordable and can last until your child reaches adulthood, term insurance may be an especially good option for single parents who want a safety net for their child in the event of their death.

Newlyweds: Secure Your Future With Term Life Insurance

According to quotes from more than 30 insurers, the average monthly premium for a 42-year-old man in good health applying for a 30-year term policy with a $250,000 death benefit is $33.24 per month. For a comparable female applicant, it is $27.31.

Various factors will of course change the price. For example, a larger death benefit or a longer policy period will certainly increase the premiums. Also, most policies require a medical exam, so any health issues could raise your rates above the norm as well.

Because term insurance eventually expires, you may find that you’ve spent all that money for no purpose other than peace of mind. Also, you can’t use your investment in term insurance to build wealth or save taxes like you can with other types of insurance.

Whole life is a form of permanent life insurance, which differs from term insurance in two main ways:

Alabama Life Insurance Exam| Latest Exam 2023 Latest Exam…

Most life insurance policies are ‘balanced premium’, meaning you pay the same monthly premium for the life of the policy. Those premiums are divided in two ways. One part of your payment goes towards the insurance component, while the other part helps build your cash value, which grows over time.

Many providers offer guaranteed interest, although some companies sell participating policies, which pay non-guaranteed dividends that can increase your overall return.

Typically, your cash value does not accrue until two to five years after coverage begins. Once it does, however, you can borrow or withdraw from your cash value amount, which grows on a tax-deferred basis. For example, you may want to take out a loan to pay for expenses such as college tuition or repairs to your home.

The advantages of policy loans over other types of loans are that there is no credit check and the interest rates can be lower. You also don’t have to repay the loan, but you reduce your death benefit because of it. Withdrawals are generally tax-free if you do not withdraw more than you have paid into the policy.

Living Benefits Of Life Insurance

The ability to withdraw or borrow from a whole life insurance policy makes it a much more flexible financial tool than a term policy.

Unfortunately, death benefits and cash value are not entirely separate attributes. If you borrow from your policy, your death benefit will be reduced by the equivalent amount if you don’t pay it back. For example, if you take out a $50,000 loan, your beneficiaries will receive $50,000 less, plus any accrued interest, if the loan is still outstanding.

The main disadvantage of whole life insurance is that it is more expensive than term insurance – quite a bit. Permanent insurance costs an average of five to 15 times more than term insurance for the same price

What is the purpose of whole life insurance, what is the purpose of life essay, what is the purpose of homeowners insurance, what is the christian purpose of life, what is the real purpose of life, what is the purpose of insurance, what is the purpose of life, what is the true purpose of life, what is the purpose of our life, what is the purpose of life christianity, what is the purpose of your life, what is the purpose of my life