The Role Of The Chief Financial Officer – What is a Virtual CFO, Its Role & Role And Why Startups Must Have a Virtual CFO What is a Virtual CFO

A Virtual CFO (Chief Financial Officer) is an outsourced service provider that provides financial expertise and strategic guidance to businesses on a part-time, as-needed, or project basis. Virtual CFOs are especially beneficial for small and medium-sized businesses that may not have the resources to hire a full-time CFO but still need financial management and consulting expertise.

The Role Of The Chief Financial Officer

Virtual CFOs work remotely and use technology to communicate and collaborate with clients. They provide a variety of financial services, such as financial planning and analysis, budgeting, cash flow management, risk management, tax planning and compliance, investor relations, and strategic decision support.

Moderna Begins New Search For Chief Financial Officer

By offering their services virtually, Virtual CFOs can provide businesses with the financial expertise they need in a more cost-effective and flexible manner compared to hiring a full-time CFO. This allows entrepreneurs to have access to efficient financial management and leadership without incurring the high costs associated with a full-time position.

A Virtual CFO (Chief Financial Officer) is an outsourced service provider that provides professional financial and strategic business guidance. Virtual CFOs can work on a part-time, as-needed, or project basis, making them a cost-effective solution for small and medium-sized enterprises that may not have the resources to hire a full-time CFO.

The duties and responsibilities of a Virtual CFO can be varied and tailored to the specific needs of the client, but in general, they include the following:

A Virtual CFO can provide significant value to a company by providing strategic financial guidance, optimizing financial processes, and ensuring regulatory compliance. By taking on these responsibilities, Virtual CFO can help businesses improve their financial performance and achieve their goals.

Role Of Cfo(chief Financial Officer)

Startups often require the services of a Virtual CFO (Chief Financial Officer) for several reasons. While hiring a full-time, in-house CFO can be expensive, Virtual CFOs offer a cost-effective solution that still provides valuable financial expertise. Here are some reasons why startups may need the services of a Virtual CFO: The term chief financial officer (CFO) refers to the chief executive officer responsible for managing the company’s financial operations. The CFO’s duties include tracking cash flow and financial plans as well as analyzing the company’s financial strengths and weaknesses and recommending corrective actions. The CFO role is similar to a treasurer or controller in that they are responsible for managing the financial and accounting departments and ensuring that the company’s financial reports are accurate and completed on time.

The chief financial officer is a member of the C-suite, a term used to describe senior executives in a company. Along with CFO, these roles include chief operating officer (CEO), chief operating officer (COO), and chief information officer (CIO).

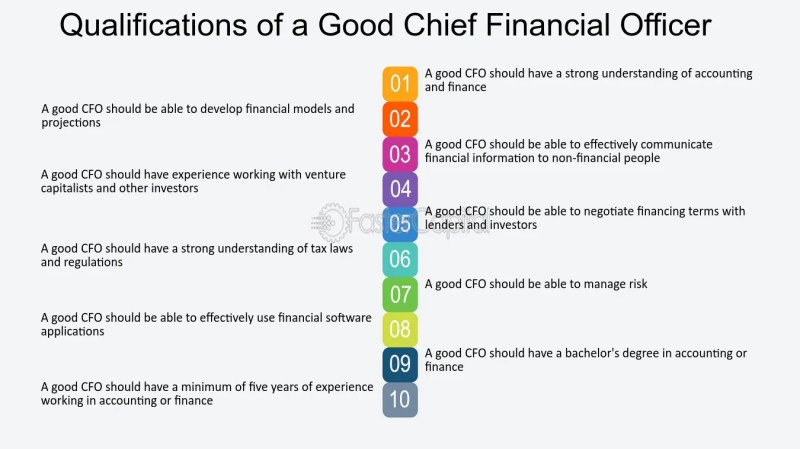

Being a CFO requires a certain degree of expertise in the industry. Most people who end up in this position have advanced degrees and certifications, such as a bachelor’s degree in finance or economics, and the Chartered Financial Analyst (CFA) designation. It also helps to have experience in accounting, investment banking, or research.

The CFO reports to the CEO but is one of the most important employees in any company. In the financial industry, it is a senior position, and in other industries, it is usually the third highest position in the company.

Cfo Roles To Dominate: The Changing Role Of The Cfo

People in this role have significant input into the company’s capital, capital structure, and how the company manages income and expenses. This corporate officer can assist the CEO with budgeting, benefit analysis, and financing for various projects.

The CFO also works with other senior managers and is important in the overall success of the company, especially when it comes to the long term. For example, when the marketing department wants to launch a new campaign, the CFO can help to confirm the feasibility of the campaign or provide information on the funds available for the campaign.

The CFO must report accurate information because many decisions are based on the information they provide. The CFO is responsible for managing the company’s financial operations and compliance with generally accepted accounting principles (GAAP) adopted by the Securities and Exchange Commission (SEC) and other regulatory bodies.

CFOs must also comply with regulations such as the Sarbanes-Oxley Act which include provisions such as fraud prevention and financial disclosure.

Yes, You Need A Cfo

Local, state, and federal governments hire CFOs to handle tax matters. Typically, the CFO is the liaison between residents and elected officials regarding accounting and other expenses. The CFO sets financial policy and is responsible for managing the government’s finances.

The role of the CFO ranges from focusing on compliance and quality control to business planning and implementation changes, and they are the key partner to the CEO. The CFO plays an important role in influencing the company’s strategy.

The United States is an international financial center and the growth of the global economy is increasing the number of jobs in the American financial industry. Companies continue to increase profits which creates a need for CFOs. The Bureau of Labor Statistics (BLS) predicts the job outlook for financial managers to grow 15% between 2019 and 2029. The average annual salary for a financial manager is $134,180 in 2020.

Generally, no, a CFO is not the same as an accountant. Accountants perform financial accounting and tax accounting services. Currently, the CFO focuses on the financial future of the company, creating a forecast.

The Significance Of Chief Financial Officer (cfo) In A Company

Generally speaking, the position of CFO is reserved for experienced professionals with an established track record in their field. CFOs generally hold an advanced academic designation, such as a Chief Financial Officer or a Certified Public Accountant (CFA) designation. Most CFOs have professional experience in areas such as accounting, investment banking, or financial analysis. For finance professionals, the CFO is one of the most prestigious and most senior positions available in a company.

No, CEO and CFO are not the same thing. However, CFOs are required to work closely with other senior company officials, such as the CEO. These executives are sometimes referred to as the company’s C-Suite, which represents the top decision-making level of the company. Although the CFO is usually subordinate to the CEO in large companies, CFOs will generally be the decision makers on all matters within their company’s Finance department.

The CFO is the chief executive officer associated with managing the company’s finances. This includes conducting all types of financial and cash flow planning, as well as analyzing the financial position. A CFO is comparable to a treasurer or controller. However, unlike the controller or accountant, the CFO is responsible for financial planning, while the other two are in charge of accounting and financial information for the company.

Requires authors to use primary sources to support their work. These include white papers, government briefings, original reports, and interviews with industry experts. We also refer to original research from other reputable publications where appropriate. You can learn more about the principles we follow in providing quality and unbiased content in our editorial policy.

Hospital Cfo Resume Example + Guide And Resume Template

The items that appear in this table come from affiliates that receive compensation. This compensation can affect how and where the list appears. does not include all the offers available in the market.

By clicking “Accept All Cookies”, you consent to the storage of cookies on your device to improve web browsing, analyze site usage, and assist in our marketing efforts. To be the chief financial officer (CFO) is to take responsibility for the company’s or the organization’s finances. It’s forward-thinking, fast, and gets a great bedroom job. CFOs span many different industries, and becoming one is a big business commitment.

A company’s chief financial officer is an important decision maker. Of course, you need a background in accounting and a degree to become a CFO. But CFOs today also lead the entire direction of an organization. They are basically responsible for the overall financial development of the company.

So what does the job involve? In this article, we’ll show you the top five jobs of a chief financial officer and explore the types of degrees that can help you develop the skills for a CFO job.

Chief Financial Officer (cfo)

All successful businesses have a financial goal. The job of the CFO is to optimize the profit margin while at the same time minimizing risk and loss. You can limit production costs and increase sales, depending on the company. Regardless of the specific financial goals, the CFO is in charge of managing these goals.

Financial goals are different for every company. For example, a CFO at a toy manufacturing company may have goals such as limiting product costs or increasing sales each quarter. Larger businesses may include goals such as expanding operations to overseas markets. All financial matters are in the hands of the president.

For many CFOs, the job means ensuring adequate risk and value. They need to interpret risk on a financial and business level. Therefore, a degree in business or finance is valuable. It teaches how to maintain strong internal control and report financial processes effectively.

Duties may include working with books, records, or financial reports. Most CFOs are raters. They use financial information to influence operational decisions.

Interim Cfo Services: Proactive Business Choices

For this reason, most CFOs have previous experience in accounting. Many people get degrees in mathematics or business. Found a Business Insider

Chief operating financial officer, the chief financial officer, role of chief financial officer, virtual chief financial officer, outsourced chief financial officer, fractional chief financial officer, chief financial officer services, interim chief financial officer, the role of chief financial officer, what is the role of chief financial officer, chief financial officer recruitment, chief financial officer course