- Medicare Part B What Does It Cover

- Opers Health Care Program

- Parts Of Medicare

- Which Medicare Part Is Right For Your Loved One? A Breakdown Of The Basics Of Medicare (infographic Included)

- What Is Medicare & Who’s Eligible?

- Medicare: What Benefits Do You Get? Part A Covers Inpatient Hospital Stays, Care In A Skilled Nursing Facility, Hospice Care, And Some Home Health

- Faqs On Mental Health And Substance Use Disorder Coverage In Medicare

Medicare Part B What Does It Cover – Medicare Part B—medical insurance—helps pay for physician services, ambulance services, outpatient care, durable medical equipment, home health care, and some preventive services.

Preventive services refer to health care that prevents illnesses like the flu or catches them early. Treatment may work best in the early stages of the disease.

Medicare Part B What Does It Cover

If you receive care from an assigned provider, you pay $0 for most preventive services.

Opers Health Care Program

You will pay a portion of the cost for services covered by Part B. Typically, you’ll pay an annual deductible ($203 in 2021). After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for most physician services, outpatient treatments, and durable medical equipment (DME).

To find out if Medicare covers your item or service, you can talk to your doctor or explore your coverage online.

Part B is slightly different than Part A. First, you must pay the standard premium amount for Part B coverage, which for 2021 is $148.50. This means you can actually refuse Part B.

However, if you decide not to enroll in Part B and then choose to enroll later, your coverage may be delayed, and you may have to pay higher premiums as long as you enroll in Part B. Your monthly premium will increase by 10% for each 12-month period you are eligible for but not enrolled in Part B — unless you qualify for a Special Enrollment Period (SEP).

Medicare Announces 2023 Medicare Cost

If you qualify for Medicare at age 65, your Initial Enrollment Period (IEP) begins three months before your 65th birthday (including your birth month) and ends three months after your 65th birthday. If you are not enrolled during your IEP, you may enroll during the General Enrollment Period (GEP) from January 1 to March 31. Your coverage will begin on July 1 of the year you enroll.

The exception to the above is if you have health insurance under a group health plan—based on your or your spouse’s employment. In this case, you may not need to file for Part B at age 65.

You may be eligible for a special enrollment period that allows you to apply for Part B during:

Have you lost your job or group health insurance? You can sign up for Medicare Part B online, by phone, or in person at your local Social Security office.

Parts Of Medicare

Keep in mind that Original Medicare does not cover every situation. If you already have Medicare, you can talk to an agent at Lacayo Group Insurance. We’ll review your options for Medicare Advantage, Part D, and Supplemental Insurance (Medigap). We’ll then help you find the best plan for your situation and make sure you understand what it covers. The Network Health 2023 Medicare Advantage PPO plan is rated 5 out of 5 stars by Medicare. learn more.

If you’re approaching 65, you’re entering a new chapter in your life. For many, this means retirement, and for others, it means grandchildren. However, for most people, it also means aging in and becoming eligible for Medicare.

Health insurance is a great perk in this next chapter of life, but we’re not going to lie… there’s a lot to learn. That’s why we’re here, to put together every piece of the Medicare puzzle into an easy-to-understand guide you can use to navigate your Medicare experience.

From now on, you are free to explore, using the table of contents to quickly jump to the sections that matter most to you. Don’t forget the Network Health team is here to assist you too, so if you have questions, give us a call at 800-983-7587.

Which Medicare Part Is Right For Your Loved One? A Breakdown Of The Basics Of Medicare (infographic Included)

Simply put, Medicare is the federal health insurance program for people who meet certain eligibility requirements. To be eligible, a person must fall into one of the following categories.

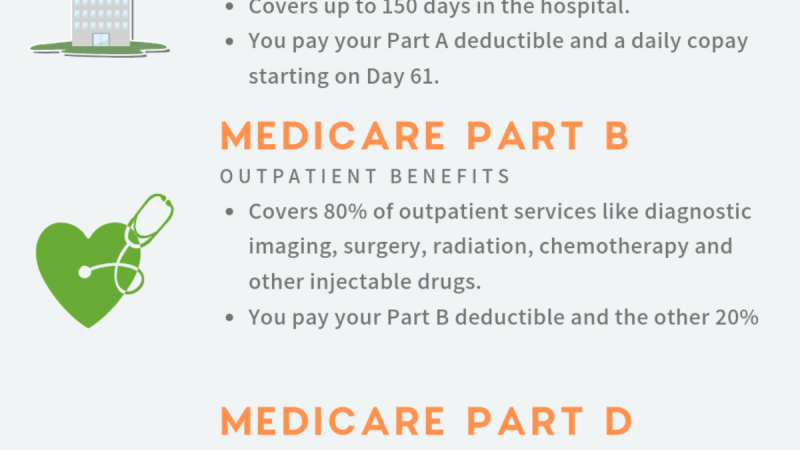

Medicare is divided into different parts, each with its own coverage benefits. What you pay for Medicare will vary based on your income and the Medicare coverage you choose, which we’ll explore below. These costs may also change from year to year.

Original Medicare is health insurance provided by the federal government. It consists of two parts – Part A (hospital insurance) and Part B (medical insurance).

Original Medicare will cover 80% of your health care costs after you meet your deductible. You are responsible for the other 20%. It’s important to know that Original Medicare does not have a maximum out-of-pocket limit. After you meet your deductible, you still have to pay 20% of all Medicare-covered medical services you receive for the remainder of the year.

Medicare’s Four Parts

Part A covers inpatient care, such as hospital and nursing home admissions. If you are receiving Social Security, you are automatically enrolled in Part A when you turn 65. If you plan to defer Social Security, you will need to apply for Part A.

Most people don’t need to pay a monthly premium for Part A because they work 40 quarters of their life and pay for it through payroll deductions. Therefore, you should always take Part A even if you keep your employer coverage. Most of the time, you pay nothing for the added coverage.

Part B covers anything done in an outpatient setting, such as doctor visits and labs. Just like Part A, if you are receiving Social Security you are automatically enrolled, but if you defer Social Security you will need to apply.

Most people pay a monthly Part B premium, so you may want to postpone this coverage if you stay on an employer plan. If your income is lower, you can pay less; if your income is higher, you can pay more. Additionally, premiums may change from one year to the next.

How Do I Sign Up For Medicare? A Simple How To Guide For You

You’ll want to review this option carefully because there are penalties for delaying Part B if your existing coverage doesn’t meet Medicare standards.

Once you have Medicare Parts A and B, you can enroll in a Medicare Part C plan—also called a Medicare Advantage plan. Medicare Advantage plans are purchased through private insurance companies such as Network Health. These plans are all-in-one alternatives to Original Medicare.

There are many benefits to Medicare Advantage plans, including this simple fact: These plans offer additional coverage not found in original Medicare. Part C plans allow for the inclusion of additional benefits such as dental, vision, hearing and fitness plans. Many Medicare Advantage plans also include Part D drug coverage, which we’ll explore below.

Medicare Advantage plans also have caps on your annual out-of-pocket expenses, while Original Medicare does not. Enrolling in Part C is a great way to avoid the rising costs of health care services.

What Is Medicare & Who’s Eligible?

Original Medicare does not include drug benefits, which is where Medicare Part D steps in, covering certain generic and brand-name drugs included in the list of covered drugs. This list is also called a formulary.

The Medicare formulary is a list of prescription drugs that the plan covers. Medicare sets standard coverage levels for the types of drugs plans must cover. Plans select specific generic and brand-name drugs on their formularies. To reduce costs, many plans divide drugs into different tiers on their formularies. Plans can be tiered in different ways, with different fees for each tier. Generally, lower-grade drugs cost less than higher-grade drugs. At Network Health, our Medicare Advantage plans (which include drug coverage) have five tiers.

Although Medicare Part D is offered as a stand-alone plan, many Medicare Advantage plans include Part D in their coverage. While Medicare Part D is an important coverage for many people, it is not without its complications. To help you understand the complexities of available drug coverage options, we recommend you read the following resources.

Just like Original Medicare, knowing what is not covered under Part D is just as important as knowing what is covered. The following are drugs that are not covered by Medicare Part D.

Medicare: What Benefits Do You Get? Part A Covers Inpatient Hospital Stays, Care In A Skilled Nursing Facility, Hospice Care, And Some Home Health

Another complexity covered in Part D is the different phases that make up the coverage phase cycle. During the year, you can achieve four drug phases based on how much you paid for the drug during the year. The stage you are in affects how much you pay for the drug.

People who take small prescriptions may be stuck in the deductible phase or enter the initial coverage phase. Those who spend a lot of money on medications, whether filling multiple prescriptions or using expensive medications, may enter the coverage gap or catastrophic phase. This cycle begins on January 1 of each year.

If your plan has a drug deductible, you will first pay the entire cost of the drug up to the deductible. Depending on your plan, the drug deductible may apply to Tier 3, 4, or 5 drugs.

Once you meet your drug deductible, you enter the initial coverage phase. At this stage, you pay the copay (a flat fee) or coinsurance (a percentage of the cost) out of pocket and plan to pay the rest. You will remain in this phase until your medication is completely exhausted

Faqs On Mental Health And Substance Use Disorder Coverage In Medicare

What does medicare part b not cover, medicare part d what does it cover, what all does medicare part a cover, what all does medicare part b cover, what does medicare part g cover, what drugs does medicare part d cover, medicare part g what does it cover, what does part a & b medicare cover, medicare part b what does it cover, medicare part a what does it cover, what does part b on medicare cover, medicare part c what does it cover