Is Fico The Most Important Credit Score – FICO credit scores can range from 300 to 850, but what is considered a good credit score? This could mean better credit cards, cheaper loans, mortgages, and more.

Your credit condition is one of the most important factors in qualifying for and getting a low interest rate on a car loan, rewards credit card, or mortgage, for example.

Is Fico The Most Important Credit Score

Your credit score is a numerical measure of your consumer credit health, a number that lenders look at when determining how creditworthy you are, that is, how likely you are to pay back the money you’ve borrowed.

Major Credit Score Factors

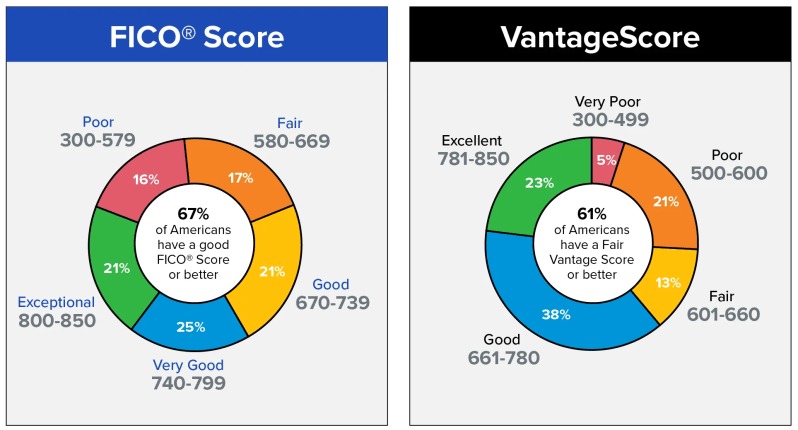

The most commonly used credit score is the FICO (Fair Isaac Corporation) Score which ranges from 300 to 850.

According to FICO, 90 of the top 100 US financial institutions use FICO credit scores. One of its competitors is VantageScore. But how are these scores determined, and what exactly makes a good (or even great) credit score range?

Your FICO score combines all of your positive and negative lending/borrowing activities, and groups them based on several factors:

All of this activity is reported to the three credit bureaus — Experian, TransUnion and Equifax — which are then listed on your credit report and, in turn, make up a large part of your credit score.

Credit Score Range: What Is A Good Credit Score?

The average credit score in the United States is 706, according to FICO.com — which puts it in the “Good” credit range.

The higher echelons of the scale – 750-799 and 800-850 – have only increased slightly over the years, according to FICO.com.

In April 2005, 20.4% of consumers had a credit score range of 750-799. In April 2019 it was at 20.7%.

The highest range, 800-850, was at 16.2% in April 2005. In April 2019, the figure increased to 22.3%. Is this an indicator that Americans are getting better in their credit habits?

What Is A Credit Score? Definition, Ranges, And More

Of course, the higher the credit score, the better types of loan products and interest rates you can get.

When it comes to credit cards, you may be more qualified for certain cards depending on your score.

For example, if you have bad credit or no credit at all, a secured credit card is an ideal “starter” card.

There are credit cards designed for people with average credit. See, they may not get any flashy rewards or perks, but they set the stage for an increase in credit score. In time, you will qualify for more favorable credit card offers.

Does Opening A New Credit Card Affect Your Credit Score?

Consumers with excellent credit are more likely to get approved for a premium rewards credit card with a luxury travel credit card or a strong cash back program.

By far, your credit score can determine the type of mortgage loan you can get when buying a home, because the interest rate you qualify for informs how much your monthly payments will be.

Consider how much you’re likely to save based on your credit score. Take a 30 year FRM, in Connecticut, with a loan amount of $100,000:

Borrowers with average credit (620-639) end up paying $536 per month at a 4.9% APR, for a total of $93,124 in interest paid.

Is A 600 Credit Score Good Or Bad?

Compare that to someone with good credit (760-850), who had an APR of 3.4%, monthly payments of $445, and total interest paid of $60,033.

The bottom of the table also illustrates how much more you’ll have to pay if your score is lower — here, we’ve provided a hypothetical example of the 700-759 range.

For example, borrowers in the 680-699 range could pay an additional $3,569 on their mortgage; drop it to 620-639, and you’ll likely be saddled with an additional $28,662.

If avoiding large differences in interest rates and payments is important to you, it’s important that you always make sure to continue improving your credit score at all costs (see also how to increase your credit score by 100 points):

What’s The Most Important Factor Of Your Credit Score?

According to MyFICO, closing a card won’t give the impression of less credit debt, and opening a new account won’t help your score either.

Even if on time, a partial payment is like a slap in the face to your lender; this tells them that they are only good enough for the amount of money you have to pay them.

Late credit card or loan payments reflect badly on your credit report and can negatively impact your credit score.

If your monthly credit card balances are too high, too often, this can offset your credit-to-debt ratio, which tells the credit bureaus that you are relying too much on credit, and this can reduce your score.

What Is A Fico Score, And Why Should You Care?

Make sure you check your credit report at least once a year; inconsistency can affect your score if an error occurs.

Look at your credit score over time to see your range, and set goals to see where you want to score.

Paul Sisolak is a personal finance journalist with an extensive background in news reporting. He covers savings, investing, real estate, and economics. Paul has contributed to major publications, including CNN, CBS, Yahoo, U.S. News & World Report, and more. Education: BA in Journalism from Monmouth University.

We believe that by providing tools and education, we can help people optimize their finances to regain control of their future. While our articles may cover or feature specific companies, vendors and products, our approach in compiling them is fair and unbiased. The content we create is free and independently sourced, without any paid promotion.

Understanding How A Fico Credit Score Is Determined

This content is not provided or commissioned by the bank advertiser. The opinions expressed here are the author’s alone, not those of the bank advertiser, and have not been reviewed, approved, or endorsed by the bank advertiser. This site may be compensated through the bank’s advertiser Affiliate Program.

Generate revenue through our relationships with our partners and affiliates. We may mention or include reviews of their products, but this does not influence our recommendations, which are based entirely on research and the work of our editorial team. We are not contractually obligated in any way to provide a positive review or recommendation of their services. View our list of partners.

Has partnered with CardRatings for our credit card product coverage. and CardRatings may receive a commission from the card issuer. Opinions, reviews, analyzes & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any entity. You’ve shopped for cars, taken a test drive, and found the perfect vehicle. But do you qualify for a car loan? Before you are approved, lenders take your credit report to determine your creditworthiness. Your credit report and credit score help them decide whether to give you a loan and what the interest rate will be.

Lenders can choose between many credit scoring models and several credit bureaus. So which credit score is usually used by car dealers?

Credit Score Statistics

When you apply for an auto loan, the lender will likely use one of the following versions of the credit score: FICO® Auto Score, Base FICO® Score, or VantageScore®. FICO® scores are used by 90% of leading lenders and VantageScore® credit scores are used by nine of the 10 largest banks.[1][2]

FICO® Auto Scores are industry-specific scores that focus on how likely you are to be late on your auto loan payments. For example, late payments (or other negative information) on a previous car loan can hurt your FICO® car score more than other derogatory items.

Instead of the traditional credit score range of 300-850, FICO® Auto Scores displays a scale of 250-900. A higher FICO® Auto Score indicates less credit risk — just as a higher score means less risk in other credit scoring models. With a higher score, you are more likely to qualify for car financing and get a better interest rate based on each car lender’s criteria. Each lender also determines what other financial information they will consider in their credit review process.

Lenders use several versions of the FICO® Auto Score. (Think about the many versions of smartphone software, and how some users will update their operating systems while others continue to use older options.)

When Was The Credit Score Invented?

The most recent version (as of this writing) is FICO® Auto Score 10, introduced in 2020. However, many auto lenders still use FICO® Auto Score 2, FICO® Auto Score 4, FICO® Auto Score 5, and FICO® Auto Score 8.

The basic FICO® score predicts the likelihood that you will be late on any credit obligations in the next 24 months. They feature a traditional score range of 300-850.

Lenders use different versions of the basic FICO® Score. FICO® Score 10 is the most recent (as of this writing). However FICO® Score 8, introduced in 2009, remains the most widely used version.[3]

In 2006, a new credit scoring option became available — VantageScore®. The VantageScore® credit score was born from a collaboration between the three major credit bureaus.

What Is The Fico Score 8?

The two newest versions of VantageScore® credit scores (3.0 and 4.0) feature an industry standard credit score range of 300-850. The old VantageScore® model had a scale of 501-990.[4]

VantageScore® is becoming increasingly popular among auto lenders. The 2019 VantageScore® Market Study Report revealed that auto lenders used nearly 131 million VantageScore® credit scores between July 1, 2018 and June 30, 2019.[5]

Your credit score will vary depending on the credit scoring model and credit bureau. Various companies will disclose their credit scores