Investing In Wind Energy: Profitable Renewable Solutions For Las Vegas – In 2022, we see an increase in the cost of raw materials, disruptions in the energy market catalyzed by global instability, and calls for governments to accelerate legislation that will help boost the installation of renewable energy.

As the wind energy industry looks to the new year, it is clear that many of the opportunities and challenges present in 2022 are likely to remain. However, recent legislation, world events and net-zero targets have highlighted the importance of investing in renewable energy. While this focus on renewables is a great opportunity for the expansion of wind power, it is not without its bottlenecks.

Investing In Wind Energy: Profitable Renewable Solutions For Las Vegas

The 2022 Offshore Wind Market Report shows that declining offshore wind prices, state-level commitments and unprecedented expansion into new lease areas caused the US offshore wind pipeline to grow by more than 13% last year.

Top Wind Energy Stocks For Q2 2023

Offshore wind is a newer industry in the United States, which positions it for rapid growth. The Inflation Reduction Act (IRA) signed in August 2022 provided $100 million for planning, modeling and analysis of interregional electric transmission generated by offshore wind, in addition to $760 million in subsidies for onshore interstate transmission lines and offshore.

The new legislation accelerates conversations about offshore wind that have previously been in short supply, which will undoubtedly spark heated debate and shape the progress of offshore wind in the US for the foreseeable future.

Additionally, an increased number of offshore wind projects will change the maintenance game. The US has limited experience in maintaining offshore wind turbines, so stakeholders will need to prepare for the unique challenges these projects present and look to global offshore wind for assistance.

In December 2022, UK Prime Minister Rishi Sunak announced a lifting of the de facto ban on new onshore wind that has been in place in England since 2015, but the pace of development is likely to be slow. Under the new proposals, onshore wind farms would have a green deal if they could demonstrate “local support” and address any negative impacts identified by the local community. Local objectors should still have important blocking rights under potential changes to the planning system which are out for consultation until April.

Ecuador’s Energy Investment Drive Targets Renewables

However, Sunak may change direction to unify and save the Conservative Party before the 2024 election. Either way, this move is a step in the right direction.

As autonomous drone inspections have become more accurate and efficient, turbine inspection data has become more robust than ever. Now that this data is available, stakeholders are looking at how they can best use it to make data-driven decisions, including when considering a move to in-house assets.

They look to identify trends from which they can draw conclusions – what happened to cause damage and why? What is likely to happen in the future and what can I do next to prevent or prepare for damage? Currently, the available data is a bit dirty and inconsistent. Cleaning and organizing it will take time, especially since the data is also in multiple places and needs to come together.

“We have noticed that owner/operators have turned to building larger teams to help manage their assets in-house. They are all trying to build a stronger knowledge base to enable their teams to operate effectively and efficiently,” said Christian Groesbeck, Senior Solutions Manager at . “A key part of this is letting the O&M data work for them. We’re proud to see Horizon as a key tool in automating and streamlining their data to give them the confidence to make the right operations and maintenance decisions when running on their own.”

Vietnam: Foreign Investors In Dire Need Of Incentives For Renewable Energy

The blades are getting bigger and the problems are becoming more prominent, especially with the rapid growth of offshore turbines. The blade design does not account for the impact of a turbine’s environment (such as lightning) or is adjusted for increased length. Original Equipment Manufacturers (OEMs) need to understand the types of damage occurring/recurring to bridge the current gap between operations and design. Additionally, climate change is affecting the frequency of blade damage from lightning, frequent storms and severe weather, flooding, and more.

Blade sensors will undoubtedly be a hot topic in 2023. They are not a silver bullet yet, but there is opportunity and history. Currently, blade sensors are too specific to damage/defects and many of them come with a high price and inconsistent performance.

“Blade sensors can provide an indication of severe blade damage and therefore reduce catastrophic failures. Unfortunately, the technology is still lacking,” said Sheryl Weinstein, Solutions Blade Engineer at . “Currently, there are too many false positives to justify the cost. Additionally, many sensors only focus on a single problem, namely lightning, rather than a holistic solution that could detect multiple failure modes. The bottom line is that these sensors have not yet met the mold, but there is opportunity and potential.”

Today, there is no perfect blade condition monitoring software (CMS) system. SCADA and CMS data can give some indication of severe blade damage, but there is too much noise and false positives. Some slides were saved by manually reviewing this data.

Renewables Will Optimize Bitcoin Mining

In addition, the sensors currently have no communication between the turbines. For example, if an extreme event occurs at one turbine, no information reaches other neighboring turbines.

Addressing this challenge in 2023 will save stakeholders a lot of time and resources and change the maintenance game.

As more and more companies look for ways to make data-driven decisions, capturing and understanding their own data is absolutely critical. 2023 is likely to see an increased number of operators considering self-operation or insisting on contract language that guarantees them quick and easy access to data collected about their turbines. There is a growing desire to own/access data and use it to make more efficient and effective decisions that will increase profits.

Compared to other renewable energy sources such as solar, the wind industry has previously lagged behind in how it integrates battery storage with generation projects. In 2023, wind plus storage projects are expected to become more popular in the global market.

A Proposed $1.7 Billion Wind And Solar Project Generates Hopes And Fears In South Central Washington State

Most of this growth will come from new build projects, but in a market where operators are looking to add capacity and maximize their assets, battery co-location will become a more attractive alternative.

As AI technology becomes more advanced and in demand, it is likely that it will soon replace some human-powered roles and lead to increased automation. However, it is important for stakeholders to remember that AI cannot magically automate entire processes overnight.

“Don’t use machine learning as a one-size-fits-all solution,” says Shweta Khushu, AI Engineering Manager at . “Always approach machine learning with the mindset of solving the problem and applying it organically when it makes sense. Don’t let data and algorithm make decisions over the human mind just yet.”

As budgets tighten and companies look for ways to cut costs, machine learning and AI is an area to watch closely.

Wind Power For Homes: Is It Right For You?

Industries across the globe face supply chain issues, but renewable energy faces a significant hurdle – permission. While the EU agreed to speed up permits for renewable energy, the US Senate failed to pass the Building America’s Energy Security in 2022 Act. Under the bill, all types of US energy and mineral infrastructure would have been accelerated , while maintaining environmental laws and community input. .

It often takes three to seven years to obtain the necessary permits, which is why stakeholders are pushing for longer-term policy changes. Developers are putting together substantial projects, lining up investors, submitting surveys and environmental studies, and trying to get permits—a process so long that typical short-term policies don’t do much to help this industry.

Without the help of all levels of government, permitting will continue to be a major challenge for the wind industry in 2023.

Global instability and climate change continue to disrupt the energy market as a whole, and the need for investment in renewables and the benefits of wind are increasingly clear. The war in Ukraine and the resulting repercussions on energy costs, particularly in Europe, show no signs of slowing down in early 2023.

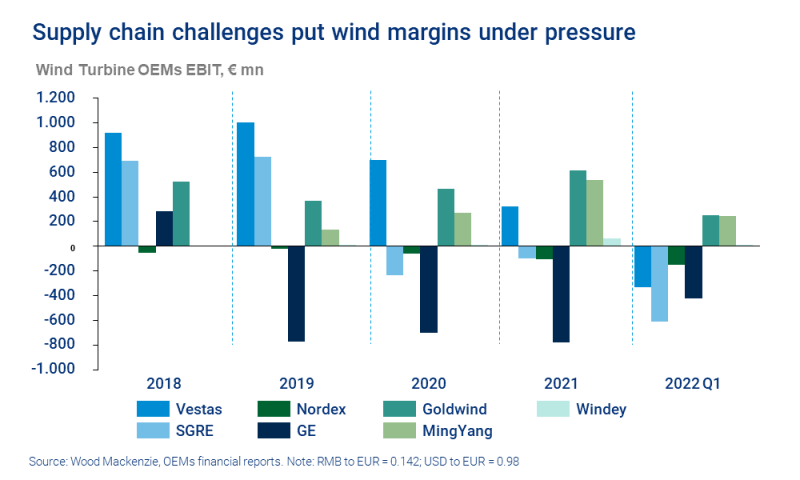

Wind Power, A Renewable Darling, Is Hurting From Inflation, Supply Chain Issues

In addition, extreme weather events caused by climate change continue to impact countries around the globe, from droughts and heat waves in Europe to powerful hurricanes and extreme cold in North America. Unless action is taken in 2023 to invest in more renewable energy sources with higher generation capacity and lower levelized cost of energy (LCOE), both consumer pockets and safety will continue to suffer.

With the start of 2023, the economic impact of the COVID-19 pandemic is still present in the global economy, and geopolitical tensions are only adding to this economic turbulence. However, governments have refocused their attention on ensuring energy security and improving grid systems, and policies and legislation are being adopted around the world to ensure energy affordability and reduce the cost of living.

The organizations and industries that will stay ahead of the pack and persist through these challenges are those that engage with experts who have the knowledge and resources to drive growth and stability.

Looking for help with wind power assets in 2023? provides technologies and services purpose-built so that our customers can deliver the world’s most efficient power generation, including management software and asset health. Global decarbonisation

Wind Turbine Farms Power Giant Tower Collapse News

Shell investing in renewable energy, investing in renewable energy companies, solutions for renewable energy, investing in renewable energy stocks, pension funds investing in renewable energy, renewable energy solutions for homes, oil companies investing in renewable energy, renewable energy investing, investing in wind energy, investing in wind energy stock, investing in renewable energy projects, investing in renewable energy