- Factors to Consider Before Buying a Business

- Valuation Methods for Determining the Purchase Price

- Financing Options for Acquiring a Business

- Negotiating the Purchase Price and Deal Terms

- Post-Acquisition Considerations for Successful Ownership

- 1. Understand the Business Culture

- 2. Keep the Key Employees Happy

- 3. Maintain Good Relationships with Suppliers and Customers

- 4. Review and Update the Business Plan

- 5. Seek Professional Support

Factors to Consider Before Buying a Business

Buying a business can be both an exciting and nerve-wracking experience. It’s a significant financial investment that requires careful consideration. Before making this big decision, there are several factors you should consider to ensure you’re making a wise investment. In this article, we will discuss some critical factors you need to take into account before buying a business.

1. Industry and Market Trends

When purchasing a business, it is essential to do your due diligence and research the market trends and insights specific to the industry in which the business operates. For instance, the technology industry is always evolving, and businesses that cannot keep up with these changes will undoubtedly lose out on profitability in the long term.

Conversely, some industries and markets remain stable and require less innovation or disruption. For example, the food and beverage industry is not as susceptible to changes as the technology industry. Therefore, before buying a business, investigate how the industry the company operates in has changed over the years and how it is likely to change in the future.

Take the time to research market trends and the general economic climate affecting the industry. When you do your market research, pay attention to the size of the market and the market share of the business you plan to purchase. This provides you with a better understanding of whether the business has the potential for growth or whether it has reached its maximum potential.

Understanding the industry trends and market movements of the business you plan to purchase is crucial in evaluating its future growth and profitability.

2. Valuation of the Business

Before buying any business, you need to determine the value of the company. The assessment should be based on tangible and intangible factors. The tangible assets include items like real estate and machinery, while intangible assets include items like brand name and goodwill.

You can also request the current owner of the business for the financial reports like balance sheets, profit, and loss statements, and cash flow. This report can help you assess the financial performance of the business and determine its profitability.

If you’re considering buying a business with a partner or investor, you should also consider how the valuation of the business affects the ownership structure.

3. Risks and Legal Considerations

Acquiring a business involves risks, and it is essential to evaluate these risks before making any commitments. Some of the risks include economic changes, management turnover, legal disputes, intellectual property issues, and labor laws.

Additionally, understanding the legal and regulatory requirements of the industry is crucial to ensure that you comply with state and federal regulations. For instance, if the business you are purchasing has several employees, you need to comply with the State and federal labor laws.

You may also need to hire a lawyer to help you with the due diligence process and ensure that the business you’re considering has a clean legal history.

4. Business Performance and Financials

Before purchasing a business, it’s essential to check the company’s financial records and performance, .i.e. assets, liabilities, debts, profits, losses, and revenue. This examination reveals the business’s overall financial health and whether it is worth the asking price.

Go through the company’s financial statements and tax documents to understand the business’s overall performance and profitability throughout the years. Analyze whether the business’s current revenue stream supports its expenses or they need to make significant changes to become profitable.

Keep an eye out for any anomalies or questionable trends, such as over-reliance on a particular client or non-payment of taxes. These factors could negatively affect the business’s future performance and growth.

5. Employees and Culture Fit

Another crucial aspect to consider before buying a business is the employee morale and culture fit. The current employee structure, their job processes, and how they interact with each other are part of the business’s operational infrastructure.

Understanding how employees contribute to the company’s success is vital in predicting the future growth of the business. When doing your due diligence, analyze whether employees are happy and motivated or have a high turnover rate. These factors give you a better understanding of the business’s strengths and limitations.

Additionally, ensure that the business aligns with your values, work ethics, and culture. This helps maintain an environment where all stakeholders thrive and increase the business’s cohesiveness and productivity.

The above factors are some of the essential considerations you should take before investing in any business. Buying a business requires dedication, time, and effort to find the right fit for your investment portfolio.

Valuation Methods for Determining the Purchase Price

If you are planning to buy a business, it is important to determine the purchase price accurately. Valuation methods for determining the purchase price can vary depending on the size, industry, and location of the business. Here are some commonly used valuation methods:

1. Asset-Based Valuation

Asset-based valuation is a method in which the value of the business is determined based on the book value of its assets. This valuation method is used for businesses that have a lot of tangible assets, such as real estate, equipment, or inventory. To calculate the asset-based valuation, the total value of the business’s assets is subtracted from its total liabilities. The resulting figure is the net asset value of the business.

Asset-based valuation may not be an appropriate method for businesses that have significant intangible assets, such as a strong brand or loyal customer base, as it may undervalue the business.

2. Earnings-Based Valuation

Earnings-based valuation is a method in which the value of the business is determined based on its potential to generate earnings. To calculate the earnings-based valuation, the business’s past and projected earnings are analyzed. This valuation method is used for businesses that have a consistent history of earnings and a clear path for future growth.

The earnings-based valuation can be calculated using several methods, including the discounted cash flow method, capitalization of earnings method, and price to earnings (P/E) ratio method.

Discounted Cash Flow Method

The discounted cash flow method involves estimating the future cash flow of the business and discounting those cash flows to their present value. The discount rate is the cost of capital, which takes into account the risk associated with investing in the business. The resulting figure is the present value of the business.

Capitalization of Earnings Method

The capitalization of earnings method involves dividing the business’s earnings by the capitalization rate. The capitalization rate is the risk-adjusted rate of return that an investor requires to invest in the business. The resulting figure is the value of the business.

Price to Earnings (P/E) Ratio Method

The P/E ratio method involves multiplying the business’s earnings by its price to earnings ratio. The price to earnings ratio is the price of the business’s shares divided by its earnings per share. The resulting figure is the value of the business.

3. Market-Based Valuation

Market-based valuation is a method in which the value of the business is determined based on the prices of similar businesses that have been sold recently. This valuation method is used for businesses that have a lot of competitors in the same industry.

To calculate the market-based valuation, the sales price of similar businesses in the same industry is analyzed. The resulting figure is the value of the business.

It is important to note that market-based valuation may not be an appropriate method for businesses that have unique characteristics or are in a niche market.

When determining the purchase price of a business, it is important to use a combination of these valuation methods to ensure an accurate valuation. Buyers should also consider the seller’s motivation for selling the business, the business’s future potential, and any risks associated with the purchase.

Financing Options for Acquiring a Business

When it comes to acquiring a business, financing is perhaps the most critical aspect. After all, few people can buy a company entirely in cash. Fortunately, there are several financing options available to help you close the deal. Here are three of the most popular financing options for acquiring a business:

1. Traditional Bank Loans

Traditional bank loans are one of the most common sources of financing for business acquisitions. These loans are often secured by the assets of the business being acquired and can be used to cover a variety of expenses, including the purchase price, closing costs, and working capital. In general, banks are more likely to approve loans if the business being acquired is profitable, has a strong credit history, and has a solid business plan in place. However, these loans can be challenging to obtain and take longer to process than some other financing options.

It’s also important to note that banks typically require a significant down payment, often 20 to 30 percent of the purchase price. This can make buying a business with a bank loan cost-prohibitive for some buyers.

2. SBA Loans

The Small Business Administration (SBA) offers several loan programs specifically designed to help small business owners acquire companies. These loans are similar to traditional bank loans but are partially guaranteed by the SBA, making them less risky for lenders and more accessible to borrowers.

The two most popular SBA loan programs for business acquisitions are the 7(a) loan program and the 504 loan program. The 7(a) loan program is the most flexible, allowing borrowers to use the funds for a variety of purposes, including acquisitions, working capital, and expansion. The 504 loan program, on the other hand, is designed specifically for real estate and equipment purchases and cannot be used to cover working capital or other expenses.

One of the main advantages of SBA loans is that they typically require a smaller down payment than traditional bank loans, often as little as 10 percent of the purchase price. However, the application process for SBA loans can be lengthy and requires extensive documentation.

3. Seller Financing

Seller financing is a popular option for business acquisitions, particularly for smaller transactions. In this type of financing arrangement, the seller of the business finances part of the purchase price, allowing the buyer to make smaller down payments and pay the remainder over time.

Seller financing can be an attractive option for buyers because it often requires little or no collateral and may come with more flexible repayment terms than bank loans. From a seller’s perspective, financing part of the purchase price can help attract more buyers and may also offer tax advantages.

However, seller financing typically comes with higher interest rates than traditional bank loans or SBA loans. It’s also important for buyers to thoroughly vet the seller and the business to ensure that they are making a sound investment.

No matter which financing option you choose, it’s essential to do your due diligence before acquiring a business. Work with a team of professionals, including attorneys and accountants, to thoroughly evaluate the financials, operations, and legal aspects of the business you are considering. With careful planning and research, you can find the right financing option to help you buy the business of your dreams.

Negotiating the Purchase Price and Deal Terms

When buying a business, one of the most crucial aspects is reaching a deal on the purchase price and deal terms. It is essential to negotiate effectively as this can significantly affect the success of your acquisition. In this section, we will discuss the top four strategies for negotiating the purchase price and deal terms.

1. Be Prepared

Before sitting across the negotiating table, you need to be prepared in every sense. This means doing your due diligence, which involves collecting all the relevant information about the business and its financials. Gather information like the business’s revenue, expenses, profit margins, assets, liabilities, cash flow statement, tax filings, and so on.

Furthermore, research the market and industry in which the business operates. This will give you valuable insights into the competition, industry benchmarks, and the business’s growth potential. Armed with this knowledge, you will be in a stronger position to negotiate the purchase price and deal terms.

2. Be Realistic

When buying a business, it’s natural to have high expectations. However, it would help if you were realistic in your negotiations. A fair price for the business should take into account various factors such as its financial performance, risk profile, industry standards, and growth potential. Keep this in mind while negotiating the purchase price. A fair price benefits both parties and increases the likelihood of a successful acquisition.

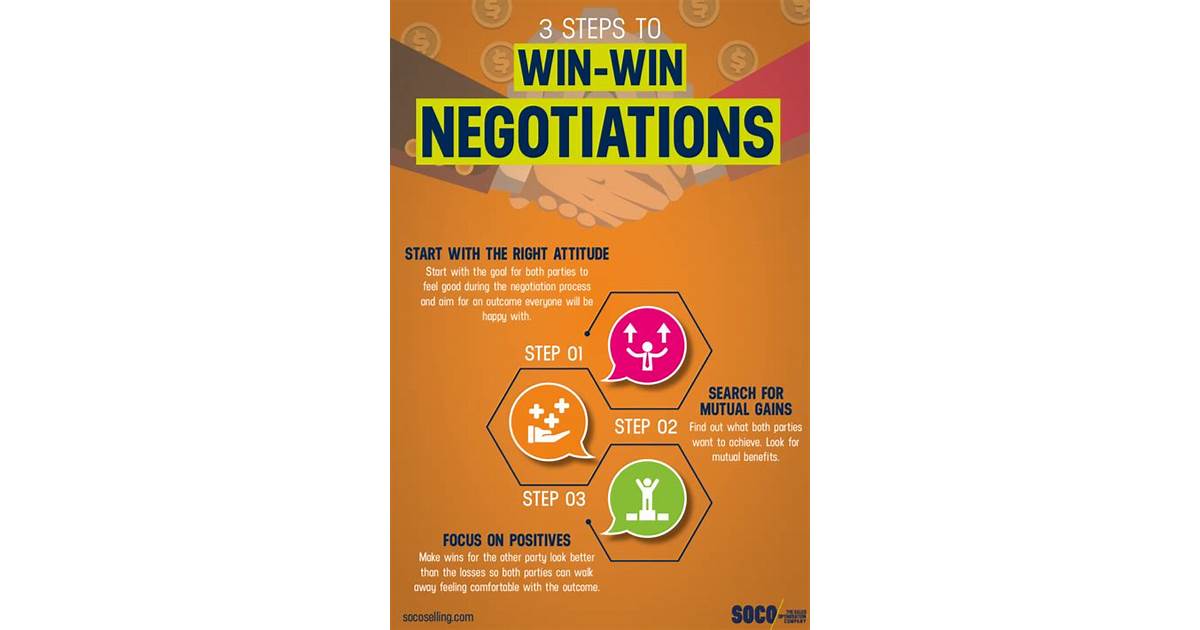

3. Create Win-Win Scenarios

Negotiating shouldn’t be viewed as a zero-sum game, where one party wins and the other loses. Creating a win-win scenario for both parties is the ideal situation. This means both you and the seller are happy with the sale price and deal terms. For example, you could offer to pay a higher purchase price in exchange for more favorable payment terms. This lets you secure the business without putting too much stress on the company’s finances.

4. Have a Backup Plan

Buying a business is a significant undertaking, and you should plan for every eventuality. This means having a backup plan should the negotiations fail. It could involve identifying other potential acquisition targets or revisiting the deal terms and purchase price. Having a backup plan will help you avoid making hasty decisions that may negatively affect your business.

Negotiating a business purchase requires a mix of preparation, realism, creativity, and foresight. You must approach negotiations with a clear head and a willingness to compromise. Follow the above strategies to ensure you secure a fair deal that sets you up for long-term success.

Post-Acquisition Considerations for Successful Ownership

Acquiring a business is an exciting and challenging endeavor. However, successfully owning a business requires more than a smooth transaction. In this article, we will discuss five post-acquisition considerations for successful ownership.

1. Understand the Business Culture

Every business has its unique culture. Understanding and adapting to the acquired business’s culture is essential for a smooth transition. It helps to foster a positive work environment and relationship with the employees and customers. The new owners can either assimilate their culture or blend the old and new cultures. However, it is crucial to make it clear to all stakeholders what is expected of them in the new culture.

2. Keep the Key Employees Happy

Retaining key employees is as important as the acquisition itself. They bring valuable skills, knowledge, and experience that are crucial for the business’s success. Losing them can lead to substantial financial and operational losses. The new owners should strive to make them feel valued and appreciated by offering competitive remuneration packages, training, mentorship, and career advancement opportunities.

3. Maintain Good Relationships with Suppliers and Customers

Building and maintaining relationships with the business’s suppliers and customers is critical for its survival and growth. The new owners should ensure that the quality, quantity, and delivery of supplies are of high standards. They should also keep in touch with the customers, listen to their feedback, and address their concerns promptly. Engaging with suppliers and customers through social media, email, or the company website is an effective way to foster relationships.

4. Review and Update the Business Plan

A business plan is a roadmap that outlines a company’s objectives, strategies, and tactics for achieving its goals. After acquiring a business, the new owners should review and update the business plan to align it with their vision and objectives. They should assess the market, competition, and industry trends and consider introducing new products or services or expanding into new territories.

5. Seek Professional Support

Acquiring and owning a business can be overwhelming and daunting, especially for first-time business owners. Seeking professional support from consultants, lawyers, accountants, or business coaches can help ease the transition process. They can provide valuable insights, advice, and guidance on various aspects of the business, such as legal compliance, financial management, marketing, and human resource management, among others.

In conclusion, successful business ownership requires more than a smooth transaction. It involves understanding the business culture, retaining key employees, maintaining good relationships with suppliers and customers, reviewing and updating the business plan, and seeking professional support. By paying attention to these post-acquisition considerations, new owners can increase their chances of succeeding and thriving in their new venture.