Difference Between Term And Whole Life Insurance – Life insurance is essential for families. The two most common types of life insurance are term and whole. Read on for our expert advice to help you decide which type of policy will best meet your family’s needs.

Term life insurance offers your family insurance with a fixed monthly premium for a specific period of time. Whether the term is 10 or 30 years, you will be reimbursed at the approved rate applicable for the term specified for that term. This means that if you die during the policy term, your beneficiaries will receive the death benefit from the policy. This type of insurance is affordable and makes it easy for most families to get the right amount of coverage for their needs.

Difference Between Term And Whole Life Insurance

Most families need life insurance to create a death benefit for their surviving spouse and children. When deciding on a death benefit amount, most families want to compensate the surviving spouse by replacing income, paying off major expenses like home loans, and sending the children to college. In most cases, the length term is suitable for children who are independent or you, the insured, to reach the age of 65.

Term Life Vs Whole Life Insurance

Whole life insurance offers permanent coverage and comes at a premium. Whole life insurance is like owning a home – you build equity in the policy, and that equity can grow your death benefit or be used to borrow against it. Whole life insurance combines death insurance with investment. The more you pay into your policy, the more your family will get out of it. The money collected is also tax-deductible, so you don’t have to pay taxes when you pay it. You can borrow against your policy if you need to, but this will reduce the amount your beneficiaries will receive in the event of a default. Whole life insurance comes with guaranteed benefits and high costs, making it suitable for high-income families. This is generally not important for the life insurance needs of everyday families.

Life insurance isn’t the same for all families, but with a little research and a clear understanding of your family’s financial situation, you can choose the best coverage for your specific needs. If you’re looking for guidance on choosing the right type of policy, contact one of our representatives.Laura McKay is the co-founder and CEO of Canada’s fastest growing digital life insurance company. In 2021, she was named one of Bay Street Bull’s Women of the Year. Laura holds a BA in Mathematics from the University of Waterloo. His degree focuses on actuarial science, which includes the study of mortality risk, life insurance pricing, and valuation fundamentals. After graduation, he was employed by Manulife and Munich Re in actuarial science. Laura then worked at the renowned management consulting firm Oliver Wyman in New York from 2013-2018. In this role, he worked with many Fortune 500 life insurance companies, helping them develop growth strategies, operational challenges and regulatory challenges.

Offers the best life insurance rates in Canada for term life insurance combined with a seamless online experience. Get an online quote in seconds.

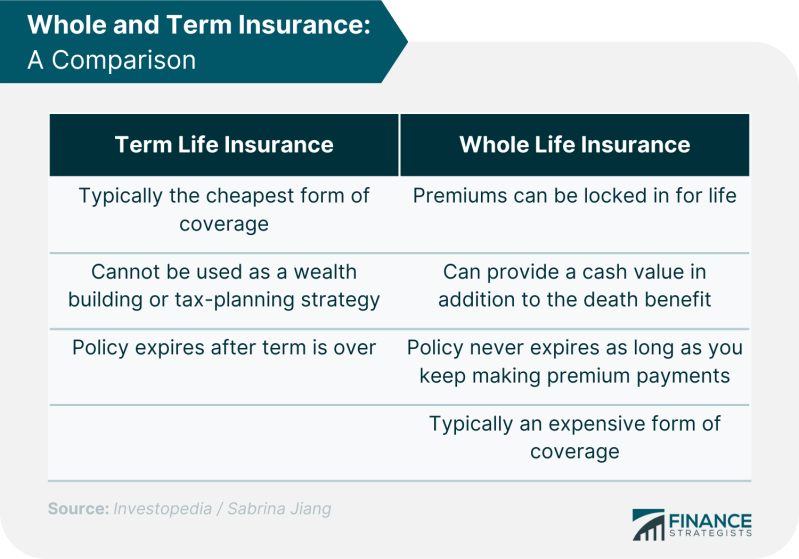

If you TL for the main difference between term and whole; If you are looking for the DR version, see the table below:

Difference Between Term, Universal And Whole Life Insurance [infographic]

Whole life insurance is suitable for high-income Canadians who need estate planning. And life insurance is only meant to replace your income in the event of your death. It is not intended to help you invest your money effectively.

Canadians are wise to it. According to the Canadian Life and Health Insurance Association, term life insurance grew by 39 per cent in 2020, while whole life insurance grew by just 12 per cent.

Term life insurance meets the needs of most Canadian families. This will reduce the cost of life insurance in Canada as well.

Ways to invest your money other than whole life insurance. Options like an RRSP or TFSA will generate more money for your loved ones after you’re gone.

Term Vs Whole Life Insurance: Which Is Right For You?

To learn more about how term and whole life insurance compare, watch this quick explainer video.

We have defined the difference between term and whole life insurance. But how to determine which policy

Life is added; If you’re like most families whose paycheck supports groceries, debt payments, savings, etc., a low-cost term policy may be right for you.

A life insurance policy is guaranteed to pay out eventually unless you die in a way not covered by your life insurance policy.

Vgli And Valife: What’s The Difference?

Term life insurance pays out only in case of death during the term. Because this term helps protect you during a “temporary” time, such as when the kids are young or while you’re paying off your mortgage.

It costs more to insure when you’re old than when you’re young. Insurance companies make up for this by charging more for permanent life insurance up front.

In a sense, you pay up front when you are young and healthy and have to pay lower monthly premiums. This is because the insurance company knows that you need to insure when you are old and at high risk of death. In fact, they will have to cover you until you are 80 years old.

On the other hand, you pay a fixed monthly premium with term life insurance because the payments are consistent throughout the life of your coverage.

Term & Whole Life

Term life insurance works to protect your loved ones for a specific period of time when they need financial protection through life insurance.

This can happen if you have dependent children or if you have large debts such as a mortgage or school loans.

You only pay for coverage over 10, 20, or 30 years if the risk of death is lower, unlike whole life insurance, which lasts a lifetime. As a result, term life insurance is much cheaper than whole life insurance.

And even better, it has the most affordable term rates in Canada. See the comparison chart below to see how we stack up against other companies.

Difference Between Term And Whole Life Insurance

Get the most affordable term insurance with the same high quality coverage as term life insurance. Get $10,000 in free life insurance for each child (and children) you have on top of your policy. There are no additional costs or hidden fees.

To make the right decision with coverage, it helps you know the meat-and-potatoes differences between term and whole life insurance. Let’s find out what each option means below!

Whole life insurance is a type of permanent life insurance where the policy lasts for your entire life and the life insurance premium is designed to grow in cash value. But if your TFSAs and RRSPs aren’t maxed out, it’s not a very effective investment method.

In theory, this sounds like a great type of policy, but there are other costs that make it less profitable. It is more expensive and less flexible than other life insurance policies.

What Is Whole Life Insurance?

And whole life insurance policies are also full of fine print, making them complicated and difficult to understand. This is an actual example of a whole life insurance contract:

You can read our comprehensive guide to whole life insurance to learn more about the benefits of whole life insurance, how the cash value system works, and pricing.

Term life insurance works by providing protection for a predetermined period of time, usually between 10 and 30 years. If you die during the agreed term, your beneficiaries will receive the amount you paid.

Your loved ones can use this death benefit to replace your income, pay off debts, support children’s education or cover other living expenses.

Whole Life Insurance Vs Term Life Insurance

Term life insurance policies in Canada have much lower annual premiums than whole life insurance policies. But premiums may increase if you renew the policy. Even though the annual premiums are high, it is a better financial investment than whole life insurance.

Removes the cost barrier to term life insurance, providing the same high-quality coverage at a better price. And by removing inefficient steps from the admin and application process, we can offer the lowest prices in Canada.

The application process for term life insurance and whole life insurance is relatively similar, if not exactly the same. It depends on the company you are applying to. The application process is so similar that life insurance companies require the same amount of information from the applicant regardless of the type of life insurance. Of course, there are exceptions to this, such as simplified insurance coverage or funeral expenses insurance.

But when looking at term and whole life insurance, the main difference in the application process comes down to the point at which you choose the specifics of the policy (such as term, riders, investment components, etc.). Otherwise, you can expect almost the same course. action in applying to each.

Plr Action Guides, Coaching Handouts & Lead Magnets

The bottom line is that we believe

Difference between whole life and term life, the difference between term and whole life insurance, difference between whole and term life insurance, whats the difference between term and whole life insurance, difference between whole life and term insurance policy, difference between whole and term insurance, what the difference between term life and whole insurance, difference between term universal and whole life insurance, difference in term and whole life insurance, what's the difference between term and whole life insurance, difference between whole life and term life insurance policies, what is the difference between term and whole life insurance