Compensation Structure

Insurance sales professionals are typically compensated through a combination of base salary, commissions, and bonuses. The specific structure of the compensation package can vary depending on the size and type of insurance company, as well as the experience and performance of the individual salesperson.

Base Salary

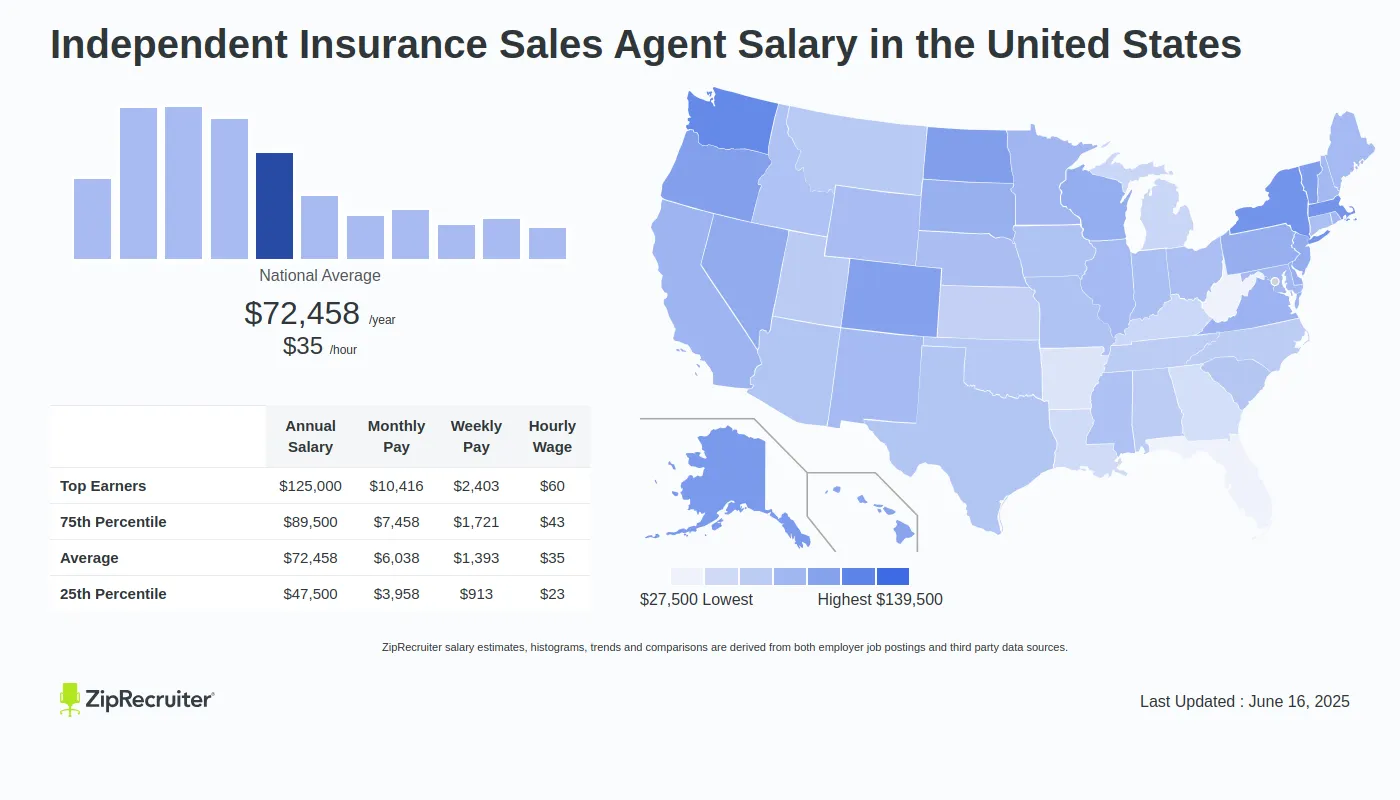

Base salary is a fixed amount of money that is paid to the salesperson on a regular basis, regardless of their sales performance. Base salaries for insurance sales professionals can range from $30,000 to $80,000 per year, depending on factors such as experience, location, and company size.

Industry Trends

The insurance industry is undergoing significant transformations driven by technology, regulation, and demographic shifts. These trends are reshaping the landscape of insurance sales and impacting the salaries of insurance sales professionals.

Technology

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are automating underwriting, claims processing, and customer service, reducing the need for manual labor and increasing efficiency. This can lead to lower costs for insurers and potentially higher salaries for sales professionals who can leverage these technologies.

- InsurTech: InsurTech startups are disrupting the industry with innovative products, services, and distribution channels. These companies are often more agile and customer-centric than traditional insurers, creating competition and driving up salaries for sales professionals with expertise in these new technologies.

- Data Analytics: Big data and analytics are enabling insurers to better understand their customers, tailor products, and improve risk assessment. Sales professionals who can effectively use data to identify and target potential customers can earn higher commissions.

Regulation

- Increased Regulation: Regulatory changes, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, have increased compliance costs for insurers and led to higher demand for sales professionals with a deep understanding of regulatory requirements.

- Consumer Protection Laws: Laws protecting consumers from unfair or deceptive practices have made it more important for sales professionals to be transparent and ethical in their dealings with customers. This can lead to higher salaries for sales professionals with a strong reputation and track record of compliance.

Demographics

- Aging Population: The aging population is increasing demand for long-term care insurance and other products tailored to seniors. Sales professionals who specialize in these areas can command higher salaries due to their expertise and the growing market.

- Millennials and Gen Z: Millennials and Gen Z consumers have different insurance needs and preferences than previous generations. Sales professionals who can effectively engage with these demographics can earn higher commissions by tailoring their sales strategies accordingly.

Comparison to Other Sales Professions

Insurance sales professionals generally earn comparable salaries to those in other sales professions. However, there are some key similarities and differences in compensation structures and job responsibilities that can affect earnings.

One similarity is that both insurance sales professionals and other sales professionals typically earn a base salary plus commission. The base salary is a fixed amount that is paid regardless of performance, while the commission is a variable amount that is based on sales volume. The commission rate can vary depending on the type of insurance product being sold and the sales professional’s experience and performance.

Job Responsibilities

Another similarity is that both insurance sales professionals and other sales professionals are responsible for generating leads, building relationships with clients, and closing deals. However, there are some key differences in the job responsibilities of these two types of sales professionals.

- Insurance sales professionals typically have a deeper understanding of the insurance products they are selling. This is because insurance products can be complex and technical, and it is important for sales professionals to be able to explain them clearly and accurately to clients.

- Insurance sales professionals often have to deal with more regulations than other sales professionals. This is because the insurance industry is heavily regulated, and sales professionals must be aware of all of the applicable laws and regulations.

Earnings Potential

The earnings potential for insurance sales professionals is generally comparable to that of other sales professionals. However, there are some factors that can affect earnings, such as:

- The type of insurance product being sold

- The sales professional’s experience and performance

- The size of the sales territory

- The competitive landscape

Overall, insurance sales professionals can earn a good living, and the earnings potential is comparable to that of other sales professions.

Additional Resources

To further your professional development in insurance sales, explore the following resources:

These platforms provide valuable insights, career guidance, and industry updates to enhance your knowledge and skills.

Websites

- National Association of Insurance and Financial Advisors (NAIFA): https://www.naifa.org/

- Independent Insurance Agents & Brokers of America (IIABA): https://www.iiaba.net/

- The National Alliance for Insurance Education & Research: https://www.the-alliance.org/

Articles

- “The Ultimate Guide to a Successful Career in Insurance Sales” by The Balance Careers: https://www.thebalancecareers.com/how-to-become-an-insurance-agent-2062316

- “How to Increase Your Income as an Insurance Sales Agent” by Insurance Business America: https://www.ibamag.com/article/how-to-increase-your-income-as-an-insurance-sales-agent-120420

Books

- The Insurance Salesperson’s Survival Guide by J. Keith Dunbar

- Selling Insurance: The Complete Guide to Success by John F. Mancini