- Understanding Freight Factoring Companies

- Factors that Affect Freight Factoring Fees

- A Breakdown of Freight Factoring Costs

- Comparing Freight Factoring Fees from Different Companies

- 1. Factoring Rate

- 2. Advance Rate

- 3. Factoring Contract Length

- 4. Hidden Fees

- How to Negotiate Fees with a Freight Factoring Company

- What Fees do Freight Factoring Companies Charge?

- How to Negotiate Fees with a Freight Factoring Company

Understanding Freight Factoring Companies

Freight factoring is a common way for transportation companies to get quick access to cash. Generally, the process involves selling your accounts receivables to a factoring company, which in turn gives you immediate cash for the invoices they purchase. This allows you to receive payment for your outstanding invoices upfront, rather than having to wait for customers to pay their bills. Essentially, freight factoring is a form of cash flow financing. It gives businesses the ability to monetize their outstanding invoices instantly to improve cash flow and support their ongoing operations.

The purpose of factoring is to address cash flow challenges that come with the gap between the time you issue an invoice and the time that the customer actually pays, which is typically between 30 and 90 days. This gap can be financially straining on the transportation company, particularly smaller or growing businesses that have limited access to capital. Freight factoring companies can provide the necessary funding to keep business operations going while waiting for customer payments to come in.

Typically, freight factoring companies charge a factoring fee, which is a percentage of the invoice value. This fee varies among different factoring companies and depends on the specific terms of their agreement. Generally, factoring fees can range from 1% to 5%, with an average charge of around 3%. Additionally, factoring companies may charge other fees, including application fees, credit check fees, and funding fees. Transportation companies looking to use freight factoring services should consider all of the costs associated with factoring, as fees can add up quickly.

The fee charged by freight factoring companies is not the only factor that determines the cost of factoring. The cost also depends on the type of factoring company you choose. Recourse factoring companies and non-recourse factoring companies operate differently and have varying degrees of risk liability, which affects the cost of factoring. Recourse factoring companies require you to buy back the invoices if the customer fails to pay, while non-recourse factoring companies assume the risk of invoice non-payment. Non-recourse financing typically incurs higher fees due to the additional risk that factoring companies assume.

When it comes to choosing a freight factoring company, it is essential to consider different factors beyond the fees charged. The company’s reputation and experience, reliability, flexibility, customer support, and financing options are all critical factors that companies should evaluate when selecting a factoring company. The best factoring company for one transportation company may not necessarily be the best option for another.

In conclusion, freight factoring can provide a solution to the cash flow challenges that many transportation companies face. The cost of factoring depends on many factors, including the fees charged by the factoring company, the type of factoring company used, the size of the company, and the industry. Transportation companies looking to improve their cash flow and monetize their outstanding invoices should consider all the potential costs and benefits of freight factoring and select a factoring provider that can help meet their specific business needs.

Factors that Affect Freight Factoring Fees

Freight factoring companies provide a useful service to trucking companies that need cash flow. Instead of waiting to get paid by their customers, they can sell their invoices to a factoring company and get paid upfront. However, freight factoring fees can be a significant expense for trucking companies, affecting their profit margins. If you’re considering using a freight factoring service, it’s essential to understand the factors that affect their fees.

1. Size of the Factoring Company

The size of the factoring company can play a role in the fees they charge. Larger companies with more resources and a broad customer base may charge lower rates since they can offer more competitive financing terms. However, smaller companies may charge higher rates to cover their overhead costs, such as IT infrastructure, personnel, and marketing.

2. Type of Industry

Freight factoring companies can serve various industries, such as construction, healthcare, and retail. However, the risk associated with each industry can vary, leading to different fee structures. For instance, the trucking industry may have higher factoring fees than healthcare since it’s more volatile and has a higher risk of non-payment. Additionally, factoring companies may have different fees based on the size and experience of the trucking company. For example, start-ups and small companies may have a higher fee structure than established ones.

3. Customer Creditworthiness

The creditworthiness of the trucking company’s customers can affect the factoring fees. If the customers have a history of late payments or defaulting on their invoices, the factoring company may charge higher rates to cover the risk. Additionally, if the customer has a lower credit score, the factoring company may require more collateral or advance rates to minimize the risk.

4. Volume of Invoices

The volume of invoices the trucking company wants to factor also affects the fee structure. Generally, the more invoices a company wants to factor, the lower the fee rates they can get. Factoring companies make money by deducting a percentage of the invoice value as fees. Therefore, larger volumes mean more revenue for them and lower rates for trucking companies.

5. Payment Terms

The payment terms for the invoices can also influence the fees charged by factoring companies. Lengthy payment terms can mean a longer waiting period for trucking companies, leading to higher financing costs. Moreover, factoring companies may charge higher rates for invoices with longer payment terms to compensate for the increased risk of late payments or default. Conversely, invoices with shorter payment terms may have lower fees since they’re less risky.

6. Seasonal Demands and Market Conditions

Seasonal demands and market conditions can affect the supply and demand of factoring services, leading to different fee structures. For instance, during peak periods, such as the holiday season, factoring companies may charge higher rates to accommodate the increased demand for cash flow. Additionally, economic conditions, such as interest rates and inflation, may also affect the fee structures of freight factoring companies.

In conclusion, understanding the factors that affect freight factoring fees is essential for trucking companies looking to choose the right factoring company. By considering these factors, trucking companies can find a company that suits their needs and offers competitive financing terms.

A Breakdown of Freight Factoring Costs

Freight factoring is an excellent financial tool for small trucking companies and owner-operators who need to boost their cash flow. The process involves selling your accounts receivable to a factoring company at a discounted rate in exchange for a lump sum cash payment upfront. In most cases, the factoring company pays between 90% and 97% of the invoice value to the trucking company or owner-operator, and then collects the full amount from the customers.

However, freight factoring costs can vary significantly from one factoring company to the next, depending on several factors. In this article, we will explore the different types of fees charged by freight factoring companies and provide a detailed breakdown of freight factoring costs.

1. Factoring Fee

The factoring fee is the primary cost associated with freight factoring. This fee is a percentage of the invoice value that the factoring company charges for its services. The average factoring fee ranges between 1.5% and 5%, depending on the volume of your business and the creditworthiness of your customers.

The factoring fee is usually calculated weekly or monthly based on the outstanding invoices in your factoring account. For example, if the factoring fee is 3% and you have $10,000 outstanding invoices in your factoring account, you will pay $300 as a factoring fee.

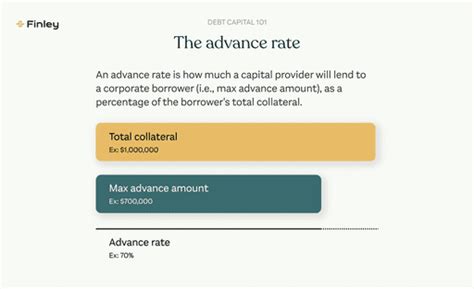

2. Advance Rate

The advance rate is the percentage of the invoice value that the factoring company advances to the trucking company or owner-operator upfront. As mentioned earlier, the average advance rate ranges between 90% and 97%, depending on the creditworthiness of your customers.

The advance rate determines the amount of cash you will receive upfront, so it is essential to negotiate the best possible advance rate with your factoring company. For example, if the invoice value is $10,000, and the advance rate is 95%, you will receive $9,500 upfront, and the factoring company will collect the full amount from your customers.

3. Other Fees

Aside from the factoring fee and advance rate, some factoring companies may charge additional fees for their services. The most common types of fees include:

Setup Fee: Some factoring companies may charge a one-time setup fee for opening a factoring account.

Monthly Minimum: Some factoring companies may require a minimum volume of business each month to maintain your factoring account. If you fail to meet the monthly minimum, you may be charged a penalty fee.

Invoice Processing Fee: Most factoring companies charge an invoice processing fee, which is a flat fee charged per invoice. The average invoice processing fee is between $1 and $5 per invoice.

Credit Check Fee: Some factoring companies may charge a credit check fee to verify the creditworthiness of your customers. The average credit check fee ranges between $10 and $40 per customer.

It is important to read the contract carefully and understand all the fees charged by your factoring company before signing up for their services. Understanding the costs involved will help you choose the best factoring company that suits your business needs and budget.

In conclusion, freight factoring costs can vary significantly depending on the factoring company and the terms of the agreement. The factoring fee, advance rate, and other fees such as setup fee, monthly minimum, invoice processing fee, and credit check fee are some of the costs associated with freight factoring. Understanding these costs will help you make an informed decision when choosing a factoring company.

Comparing Freight Factoring Fees from Different Companies

When choosing a freight factoring company to work with, it is essential to compare their fees so that you can make an informed decision that aligns with your financial objectives. The fees that freight factoring companies charge typically vary depending on the company, the industry, and the creditworthiness of their clients. Here are some of the factors that influence the charges freight factoring companies levy:

1. Factoring Rate

The factoring rate is the percentage of each invoice’s total worth that the freight factoring company will take as its compensation. It typically ranges from 0.5% to 5%. Factoring rates can be lower or higher depending on the size of the invoice and the creditworthiness of the client. Clients with high creditworthiness are charged lower factoring rates, while those with a low credit score are charged higher. Thus, it is essential to analyze your business’s creditworthiness to determine your eligibility for the best possible rates.

2. Advance Rate

The advance rate is the percentage of the invoice amount that the freight factoring company pays upfront. It varies from company to company and can be influenced by your creditworthiness, the industry you work in, and the size of the invoice. Advance rates for the trucking industry are typically between 85% and 95%.

3. Factoring Contract Length

Most freight factoring companies require clients to sign a factoring contract. The contract contains important information such as the length of the contract, the fees associated with the factoring agreement, and more. The length of the contract can last from one month to a year or longer, depending on the company. Longer contracts typically mean lower factoring rates.

4. Hidden Fees

Some freight factoring companies may charge hidden fees that are not immediately apparent, and these costs can add up significantly. Hidden fees can include application fees, setup fees, wire transfer fees, invoice submission fees, account maintenance fees, and more. It is crucial to read the contract carefully and clarify with the factoring company any fees that are not clear.

In conclusion, when choosing a freight factoring company, it is essential to compare fees and ensure you understand all the costs associated with the factoring agreement. Be sure to ask the right questions to avoid any hidden fees and verify that the advance rate and factoring rate align with your expectations. Ultimately, you want to select a freight factoring company that aligns with your financial goals, strengthens your cash flow, and offers value-added services to help you grow your business.

How to Negotiate Fees with a Freight Factoring Company

Freight factoring is a popular financing solution for trucking companies that need cash flow fast. This way of financing allows trucking companies to sell their invoices to a third-party company, known as a freight factoring company, which is willing to pay for those invoices upfront. But, like any other service provider, these companies charge fees for their services. In this article, we will dive deeper into how much do freight factoring companies charge and how to negotiate fees with these companies.

What Fees do Freight Factoring Companies Charge?

The fees that freight factoring companies charge are different from one company to another. However, most of them offer a similar fee structure that includes:

- Factoring fee: This is the primary fee that factoring companies charge, usually ranging from 1% to 5% of the total invoice value. This fee is charged for the service that the factoring company provides, including credit checks, collections, and advancing payment for the invoices.

- Advance rate: The advance rate is the percentage of the total invoice value that the factoring company is willing to pay upfront. This can range from 70% to 95% of the invoice value, depending on the factoring company and the creditworthiness of the client’s customers.

- Reserve: The reserve is the portion of the invoice value that the factoring company holds back until the customer pays the invoice in full. This usually ranges from 5% to 30% and is used to cover any unpaid invoices, disputes, or chargebacks.

- ACH transfer fee: Some factoring companies charge a fee for the wire transfer of funds to the client’s bank account. This fee can range from $10 to $25 per transfer.

How to Negotiate Fees with a Freight Factoring Company

When negotiating fees with a freight factoring company, keep in mind that everything is negotiable. Clients can negotiate terms and fees with their factoring company to ensure they are getting the best deal possible. Here are some tips on how to negotiate fees with a freight factoring company:

- Do Your Research: Before negotiating with any factoring company, research the market and get quotes from different providers. This will help you understand the standard rates in the industry and give you leverage when negotiating.

- Know Your Value: As a client, you are valuable to the factoring company. Therefore, know your worth and understand that you have the power to negotiate better terms. If your company has a good credit history, a high volume of invoices, or a diversified client base, use it as a bargaining chip.

- Be Prepared to Walk Away: If the terms and fees offered by the factoring company are not favorable, be prepared to walk away. There are many factoring companies on the market, and it’s essential to find the one that best fits your needs and budget.

- Be Honest: Honesty is key when negotiating with a factoring company. Be upfront about your business’s financial situation, your invoicing history, and any potential risks. This will help you build trust with the factoring provider and increase your chances of getting better terms.

- Negotiate the Advance Rate and Reserve: The advance rate and reserve are the most critical factors that will affect the total cost of factoring. Negotiate these terms based on your company’s needs, volume of invoices, and customer creditworthiness. Ask for a higher advance rate and a lower reserve if your customers have a good payment history and creditworthiness.

By negotiating terms and fees with a freight factoring company, you can save money and get better financing options. Remember to do your research, know your value, be prepared to walk away, be honest, and negotiate the advance rate and reserve. These strategies will help you get the most out of your relationship with a factoring company.