Understanding CPA (Certified Public Accountant) Services

Do you find accounting and tax jargon overwhelming? Are you continually navigating the complex world of business taxes? Do you require professional help to manage and reduce your tax bills? If your answer to any of these questions is yes, then it’s high time you considered hiring a Certified Public Accountant (CPA) to handle your finances.

A CPA is a professional accountant licensed by the state who has met specific certification and experience requirements. They are trained to provide financial expertise and insights for small and large businesses, non-profit organizations, and individuals. Hiring a CPA can help ease your financial burdens by ensuring accurate and timely financial reporting, compliance with tax laws, and wealth management.

CPAs offer a wide range of services, including tax preparation, financial planning, audit representation, bookkeeping, and business consultation. Many firms offer bundled packages that include various services. The fees charged for CPA services vary, depending on the type of service, the complexity of the project, and the level of expertise required. Below are the costs of different CPA services:

Tax Preparation Services

CPAs typically charge hourly rates for their tax preparation services. The cost depends on the complexity of the tax return, the number of forms to be filed, and the level of expertise required. The average hourly rate for CPA tax preparation services ranges from $150 to $450 per hour. Therefore, for a typical tax return with no complications, expect to pay around $400 to $700.

Financial Planning Services

CPAs have the expertise to provide personalized financial advice on various issues such as investment strategies, retirement planning, and debt management. They may offer bundled packages that include various services such as asset management, budgeting, and estate planning. A typical financial plan may cost $2,000 to $5,000, depending on the complexity of the project, the expertise required, and the tools and software used.

Bookkeeping Services

Many businesses outsource their bookkeeping function to CPAs. The fees charged for bookkeeping depend on the size and complexity of the business. Generally, the fees are charged on an hourly basis. The average hourly rate for bookkeeping services ranges from $50 to $150 per hour. Therefore, for a small business with a few transactions, expect to pay between $1,000 to $3,000 annually.

Audit Representation Services

If your business is being audited by the state or the IRS, hiring a CPA to represent you can ease your burden significantly. This service involves working with the auditor to ensure compliance with tax laws and mitigating tax liability. The charges for this service vary, depending on the complexity of the audit and the level of expertise required. Many CPAs charge hourly rates ranging from $200 to $500 per hour and may require retainers. The cost may range from $5,000 to $20,000, depending on the complexity of the audit.

Business Consultation Services

A CPA can help you make better business decisions by providing financial insights, risk assessment, internal control reviews, and market analysis. The cost of business consultation services varies, depending on the scope of the project and the level of expertise required. The average hourly rate for these services ranges from $200 to $600 per hour. Therefore, for a small business, expect to pay between $2,000 to $10,000 for consulting services.

In conclusion, the cost of hiring a CPA varies significantly, depending on the level of expertise required, the complexity of the project, and the type of service. However, hiring a CPA can significantly reduce your tax liability, ease your financial burdens, and provide you with personalized financial advice. If you are looking to hire a CPA, it is advisable to shop around, compare quotes, and ask for referrals from friends and family.

Factors Affecting CPA Fees

CPA fees can vary greatly depending on several factors. Here are some factors that can affect how much a CPA will charge.

1. Location

Location plays a significant role in determining CPA fees. In general, metropolitan areas will have higher fees due to the higher cost of living. CPAs in major cities, such as New York or San Francisco, will charge more than CPAs in smaller towns.

However, the average CPA fees can vary within the same state or even the same city. The demand for CPAs in a particular location can also impact fees. Places with higher demand for CPAs may mean that prices will be higher due to competition.

2. Experience and Qualifications

The experience and qualifications of a CPA will impact how much they charge for their services. CPAs with a higher level of experience and qualifications, such as advanced degrees or certifications, will demand higher fees. For example, a CPA with a Master’s degree in Taxation or who is a Certified Public Accountant (CPA) will charge more than a CPA with only a Bachelor’s degree.

Additionally, the amount of experience a CPA has in a particular area may impact their fees. For example, a CPA who specializes in international taxes may charge more than a general tax CPA, simply because of the additional expertise required in that specific area.

It’s important to note that while more experienced CPAs may charge higher fees, their expertise can save clients money in the long run. They may also be able to identify tax breaks or deductions that a less-experienced CPA may miss.

3. Services Required

The type of services required will impact CPA fees as well. For example, preparing a simple tax return will likely cost less than preparing a complex tax return for a business. The more complex the services required, the more expertise is needed, and the more a CPA will charge.

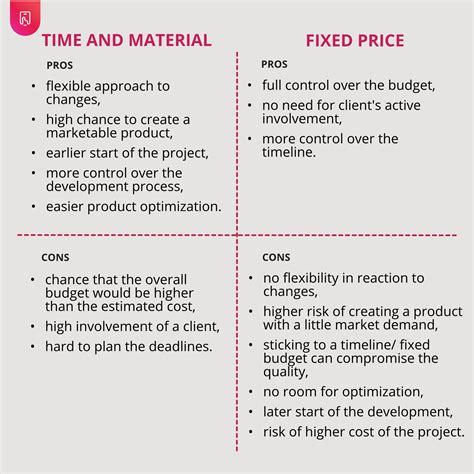

Additionally, CPAs may charge differently for their services depending on how they are employed. If a CPA is an employee of a larger accounting firm, they may charge a flat rate or an hourly rate. However, if they work independently, they may charge a fixed price for a specific service.

4. Timing and Urgency

The timing and urgency of services required can also impact fees. If a client needs a CPA’s services within a short time frame, the CPA may charge more. Additionally, if a CPA is asked to prepare tax returns close to the filing deadline, they may charge more due to the additional pressure and workload.

It’s always a good idea to plan ahead and allow enough time for a CPA to prepare your returns. This can help you avoid paying higher fees due to urgency or missing important deadlines.

5. Client Profile

The client profile is also a factor that may impact CPA fees. The complexity of a client’s financial situation may impact how much a CPA charges. For example, if a client has many investments, foreign accounts, or a high net worth, their tax returns will be more complex to prepare, requiring more time and expertise.

Additionally, CPAs may also consider whether a client has a history of being difficult to work with or if they require substantial hand-holding. This may influence a CPA’s decision to take on the client and how much they charge.

Overall, it’s essential to consider the above factors when assessing CPA fees. The cost of CPA services should be weighed against the complexity of your financial situation and the expertise required to complete the job.

Average Costs of CPA Services

When it comes to managing your finances, hiring a certified public accountant (CPA) can be a smart decision. A CPA can help you file your taxes, provide tax planning strategies, offer financial advice, and handle bookkeeping and accounting tasks. But before you hire a CPA, it’s important to understand the costs associated with their services. In this article, we’ll explore the average costs of CPA services based on three different subtopics.

1. Hourly Rates

Some CPAs charge clients by the hour, and hourly rates can vary depending on the region, the CPA’s experience, and the services provided. According to a survey conducted by the National Society of Accountants in 2019, the average hourly rate for CPA services is around $200. However, some may charge as low as $100 per hour while others may charge upwards of $500 per hour.

It’s important to note that hourly rates can quickly add up, especially for complex projects that require more time and expertise. If you’re concerned about hourly rates, you can consider negotiating a flat fee with your CPA, especially if you have a long-term working relationship.

2. Flat Fees

Many CPAs charge flat fees for services, which can be a more cost-effective option for clients with predictable needs. The flat fee typically covers a specific set of services, such as tax preparation or financial planning, and can range from a few hundred dollars to several thousand dollars depending on the complexity of the project and the CPA’s experience.

One benefit of flat fees is that you don’t have to worry about hourly rates or unexpected charges. However, keep in mind that flat fees may not be the best option for one-time or infrequent projects.

3. Percentage of Assets

CPAs who work on investment portfolios or financial planning services may charge a percentage of assets, which means they take a percentage of the total assets they manage. The percentage typically ranges from 0.5% to 2.5%, depending on the size of the portfolio, the services provided, and the CPA’s experience.

This fee structure can be beneficial because it aligns the CPA’s incentives with yours, as they have a vested interest in growing your assets. However, it’s important to understand the potential costs associated with percentage fees, especially if you have a large portfolio. Some CPAs who use this fee model may also charge additional fees for certain services or transactions.

Overall, the cost of CPA services can vary greatly depending on the CPA’s experience, the services provided, and the fee structure. It’s important to evaluate your financial needs and budget before choosing a CPA, and to ask for a clear explanation of their fees and services before you hire them. By doing so, you can ensure that you’re getting the most value out of your CPA relationship.

Different Billing Models Used by CPAs

CPAs or certified public accountants help individuals and businesses optimize their financial planning and management. While CPAs are not just tax preparers, tax planning and preparation is still a significant portion of their work. Because of this, it’s important to understand the different billing models used by CPAs to get the best value for their services.

Hourly Billing Model

The hourly billing model is the most common billing method used by CPAs. This model charges clients based on the number of hours that the CPA spends working on their accounts, tax preparation, and planning. CPAs charge varying hourly rates depending on their experience and level of expertise. The rates may range from $150 to $500 per hour. This billing method is best for small businesses or individuals with basic accounting needs or those who require minimal interaction with their CPA throughout the year.

Flat Fee Billing Model

The flat fee billing model is an alternative billing method where a CPA charges a single rate for a specific service, such as preparing a tax return. This model is beneficial for clients who are on a budget and require only one-time services. The CPA will typically charge a fixed price for the service, which provides clients with more control over their budget. However, clients should be aware that any additional services not initially covered by the flat fee will be charged separately based on the CPA’s hourly rate.

Value-Based Billing Model

The value-based billing model is becoming increasingly popular in the accounting industry. This billing method is based on the value that the CPA provides to the client, which can be determined based on the time saved, errors prevented, or the value of the advice provided. The CPA and their client agree on a fee based on the value they provide to the client, rather than the hours spent on the project. This billing method is ideal for businesses that require a high level of interaction with their CPA.

Retainer Billing Model

The retainer billing model is similar to a subscription model, where clients pay a flat fee upfront for the CPA’s services for a set period, such as a year. During this time, clients have access to the CPA’s services for an agreed-upon number of hours. This model is ideal for businesses that require regular consultations with their CPA throughout the year. The retainer model also provides clients with more predictable accounting costs, making it easier to budget throughout the year.

Understanding the different billing models used by CPAs can help individuals and businesses choose the best model for their specific financial needs. Before engaging a CPA’s services, clients should take into account their specific accounting needs, the level of service they require, and their budget to ensure they get the best value for money.

Tips to Reduce CPA Costs

Small business owners are always searching for ways to save money, and one area where cuts can be made is accounting costs. CPA (Certified Public Accountant) services can be expensive, but there are ways you can reduce your overall costs without sacrificing quality. Here are five tips you can use to reduce CPA costs:

1. Keep Accurate Financial Records

Keeping up-to-date, accurate financial records can help keep the cost of CPA services down. When you organize and track your financials, it’s easier for your CPA to manage and report on them. The more organized and thorough your financial records, the less time your CPA will have to spend collecting and organizing your financial data. This, in turn, will help you save money.

2. Streamline Your Accounting Processes

The less time your CPA spends managing your accounting processes, the more money you’ll save. Make sure your accounting processes are as streamlined as possible. This includes items like automating invoices and receipts, using accounting software, and simplifying your reporting requirements. Talk to your CPA about ways to streamline your accounting processes and reduce overall costs.

3. Be Prepared and Organized for Meetings

When meeting with your CPA, make sure you’re prepared and organized. This can help reduce the amount of time required for meetings and decrease overall CPA costs. Organize your financial records, develop a list of questions, and have all the documentation you need ready before the meeting. The more prepared you are, the quicker your CPA can answer your questions and prepare your financial reports.

4. Ask for a Fixed Monthly Fee

Many CPAs offer fixed monthly fees for their services. This can be a great way to plan your budget and reduce accounting costs over time. By paying a fixed fee each month, you can avoid surprises when the bill arrives. Discuss this option with your CPA to see if it’s available to you.

5. Consider Outsourcing Your Accounting Services

Outsourcing your accounting services can be a cost-effective alternative to hiring a full-time CPA. By outsourcing, you only pay for the services you need. Additionally, you don’t need to pay for employee benefits or worry about overhead costs. Outsourcing your accounting services can help you reduce accounting costs while also providing high-quality, professional financial services.

By following these tips, you can reduce your CPA costs without sacrificing quality or accuracy. Discuss each of these options with your CPA and gain insight into additional ways you can save on your accounting fees.