Understanding Supply Chain Finance

Supply chain finance refers to a set of financial solutions offered to businesses engaged in a supply chain, otherwise known as the process by which raw materials or goods are transformed into finished products.

Essentially, supply chain finance is a way for businesses to optimize working capital, improve cash flow, and reduce risks that usually come with the traditional financing of goods across the supply chain. It helps to drive business growth by enabling businesses to perform better, secure funding, and strengthen relationships between buyers and suppliers. It usually involves a bank or financial institution which provides financing options and enables the seller or suppliers to offer better payment terms to buyers through innovative financing techniques.

The supply chain financing process has three main players. The “buyer,” also known as the anchor company, is the organization that purchases goods and controls payment terms to their suppliers. The “supplier,” the entity that provides raw materials or goods to the buyer normally on credit terms and seeks improved payment while shorting their payment cycle. Finally, the “financier,” which is the financial institution that signs an agreement with the supplier to finance their account receivables while extending the payables terms of their customer, the buyer.

One of the critical features of supply chain finance is that it is grounded on the strength of the buyer’s credit rating, which enables suppliers to sell finished goods at a lower rate. The process comes with specific financing methods that make it easier for suppliers to receive payments faster, and for buyers to extend their payment periods without adding interest charges, empowering parties to reach mutually beneficial agreements.

There are a few types of supply chain finance methods that a supplier or buyer can choose from. One typical example is called “reverse factoring,” also known as ‘supplier financing.’ In this method, the financial institution, also called a factor, pays the supplier and executes the buyer’s previous obligation in the process. This financial provider creates a platform or an electronic account where suppliers can upload approved invoices in digital format for payment. The buyer approves the invoices and pays the factor in due time. The financier will then remit payments to the supplier, usually within 72 hours, and receives payment from the buyer on the agreed date, as determined in the initial contract agreement.

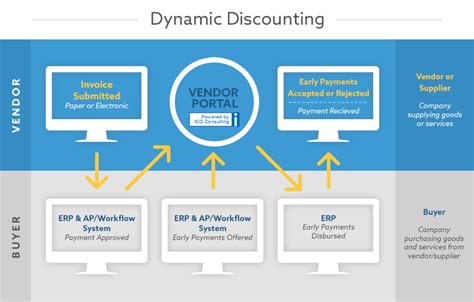

Another common method is called “buyer-centric supply chain finance,” also known as approved payables financing or dynamic discounting. In this method, the buyer’s financial institution provides additional credit capacity for the buyer to use to pay suppliers in advance. The suppliers can then offer discounts to the buyer to take advantage of early payment incentives, leading to financing rates that are significantly lower than the standard borrowing rates. This method enables businesses to access funding at substantially high rates, further reducing the cost of capital and diversifying financing solutions to capitalize on new business opportunities.

Conclusion

In summary, supply chain finance is a range of financing options that can help businesses optimize their cash flow, limit their risks, and improve their performance throughout their supply chain operations. This enables businesses to grow while providing suppliers with improved access to affordable financing. Businesses can work together with financial institutions to understand how it could fit their business models and pick and stakeholder management strategies that can work with their standard practices. With government and the private sector majority being beneficiaries of supply chain finance and observing significant improvements, it is essential that more businesses adopt this financing solution to keep up with their competition in various markets.

Key Players in the Supply Chain Finance Process

In the supply chain finance process, there are several key players involved, each with their role to play in ensuring smooth functioning of the process. These players include:

1. Suppliers

Suppliers are the ones who provide the goods or services needed by the buyer. In the supply chain financing process, suppliers are the ones who raise invoices against which financing is sought. As such, suppliers stand to benefit from supply chain finance as it enables them to get paid faster, thereby improving their cash flow. With the help of supply chain finance, suppliers can also negotiate better payment terms with their buyers.

2. Buyers

Buyers are the ones who purchase goods or services from the suppliers. In the supply chain finance process, buyers are the ones who approve the invoice raised by the suppliers. By doing so, buyers give their consent for financing against the said invoice. Buyers stand to benefit from supply chain finance as it enables them to extend their payment terms with suppliers without affecting the suppliers cash flow.

3. Finance Providers

Finance providers are the ones who provide the financing needed by suppliers against their invoices. Finance providers can be banks, financial institutions or fintech companies. In the supply chain finance process, finance providers play a critical role, as they enable suppliers to get paid faster, thereby improving their cash flow. Finance providers also benefit from supply chain finance as they earn a commission on the financing provided. They also get to earn interest on the financing extended to the suppliers.

4. Logistics Providers

Logistics providers are the ones who facilitate the movement of goods from suppliers to buyers. In the supply chain finance process, logistics providers can play a critical role, as they can provide valuable data that finance providers can use in their decision-making process. Logistics providers can also benefit from supply chain finance as they can get paid faster for their services.

5. Technology Providers

Technology providers are the ones who provide the software or platform used to facilitate the supply chain finance process. Technology providers can be banks or fintech companies. In the supply chain finance process, technology providers play a critical role, as they enable suppliers to raise invoices, buyers to approve them and finance providers to extend financing. Technology providers also benefit from supply chain finance as they earn a fee for the use of their platform or software.

Overall, the supply chain finance process is a collaborative effort between all the key players involved. By working together, the suppliers, buyers, finance providers, logistics providers and technology providers can ensure that the process runs smoothly, thereby benefiting every player in the supply chain.

Benefits of Supply Chain Finance

Supply Chain Finance (SCF) is a financial tool that helps businesses optimize their cash flow by allowing them to receive earlier payments for their invoices. SCF can benefit all parties involved in a supply chain, from the supplier to the buyer, and the financing institution. Here are some of the benefits of supply chain finance:

Benefit #1: Improved Working Capital

Working capital refers to the amount of money a business needs for its day-to-day operations. For suppliers, waiting for payment from buyers can lead to cash flow issues and affect their ability to fulfill orders in a timely manner. With SCF, suppliers can receive payment earlier, improving their working capital and enabling them to invest in growth opportunities or pay off debts. Buyers can also benefit from SCF by extending their payment terms without negatively impacting their suppliers’ cash flow and relationship with them.

Benefit #2: Reduced Risk

SCF can help mitigate the risk of non-payment between buyers and suppliers. With SCF, a financing institution takes on the risk and pays the supplier early. The buyer is then responsible for paying back the financing institution at a later date. This ensures the supplier gets paid on time and reduces the risk of non-payment or delayed payment due to issues such as bankruptcy, early payment discounts or missed payments.

Benefit #3: Competitive Advantage

SCF can provide a competitive advantage for businesses by enabling them to offer better payment terms to their suppliers. By offering early or guaranteed payment, businesses can attract quality suppliers and negotiate better pricing, delivery, or payment terms. A stronger supply chain can also help businesses differentiate themselves from competitors by providing better service and customer satisfaction.

In conclusion, Supply Chain Finance not only provides financial benefits but also increases efficiency, reduces risk, and provides a competitive advantage for businesses. By adopting SCF, businesses can achieve optimized cash flow, improved working capital, and better relationships with suppliers and customers, leading to long-term success and growth.

Types of Supply Chain Finance Programs

Supply chain finance is a type of financing that improves the financial standing of a company by providing cash flow to its suppliers earlier and paying creditors more efficiently. To do this, supply chain finance programs use financial instruments such as factoring, discounting, and reverse factoring.

Here are the four types of supply chain finance programs:

1. Factoring

Factoring is a type of supply chain finance that involves selling accounts receivables to a third-party financier or factor at a discount. Factoring provides working capital to suppliers by advancing cash on open invoices. The factor then collects from the buyer on the due date and pays the supplier less the factoring fee.

Factoring is often used by suppliers with a high level of receivables, and it is considered a quick and easy way to improve cash flow. Factoring companies could also help suppliers with the collection process to reduce their administrative costs.

2. Discounting

Discounting is like factoring, but instead of selling accounts receivable, suppliers borrow money against their accounts receivable at a discount from a bank or financial institution. The financial institution charges interest on the borrowed amount and repays them when the company can pay.

Discounting is less expensive than factoring, and it allows the suppliers to retain control over their sales ledger, which is essential in maintaining the relationship with their clients. However, it is not a suitable option for suppliers with less-than-perfect credit history.

3. Reverse Factoring

Reverse factoring, also known as supply chain finance or debtor finance, is a process in which the buyer of goods arranges financing for its suppliers from a financial institution. It works by using the buyer’s credit rating to obtain financing for suppliers at a lower rate than they could get on their own.

The buyer and supplier agree to the payment terms, and the buyer’s financial institution pays the supplier on the invoice due date, minus a small fee. Reverse factoring maintains the supplier’s cash flow, improves the buyer’s relationship with its suppliers, and provides the financial institution with a stable source of revenue.

4. Dynamic Discounting

Dynamic discounting uses technology to facilitate early payments from buyers to suppliers. Suppliers can offer the buyer discounts in exchange for early payment, allowing them to access cash more quickly. This type of supply chain finance program benefits both parties by allowing buyers to optimize their cash management and suppliers to access working capital more efficiently.

Dynamic discounting is becoming increasingly popular, as technology allows for automated payment processing, making the process more efficient, and improving the overall experience for both buyers and suppliers.

In conclusion, supply chain finance programs provide a win-win situation for both the buyer and supplier in a transaction. The buyer can efficiently manage its cash flow, and the supplier can access working capital that can be reinvested in its business. Each program has its advantages and disadvantages, and companies must consider their business needs and financial position before choosing a supply chain finance program that suits their needs.

Challenges and Risks Associated with Supply Chain Finance

Supply chain finance is a complex field that involves a network of suppliers, buyers, and financial institutions. As with any financial arrangement, there are challenges and risks associated with supply chain finance. In this section, we will explore some of the most pressing challenges and risks that companies face when implementing a supply chain finance program.

1. Information asymmetry

One of the most significant challenges in supply chain finance is information asymmetry. This occurs when one party has more information than another party in a transaction. In the context of supply chain finance, suppliers may have more information about their buyers’ creditworthiness than the financial institutions that are financing the transactions. This can lead to underpricing of risk, which can result in higher costs for all parties involved.

2. Compliance risk

Another challenge for companies that implement supply chain finance is compliance risk. This refers to the risk of violating laws or regulations that govern trade finance transactions. In particular, companies need to be aware of anti-money laundering and anti-bribery laws, as well as regulations related to know-your-customer (KYC) and due diligence procedures.

3. Credit risk

Credit risk is also a significant concern in supply chain finance. Financial institutions that provide financing to suppliers are exposed to the risk that buyers will default on their payments. This risk can be mitigated through credit insurance or credit guarantees, but it remains an ongoing concern for many companies.

4. Operational risk

Operational risk refers to the risk that a company’s day-to-day operations will be disrupted, leading to financial loss or reputational damage. For example, a supplier may be unable to deliver goods on time due to unforeseen circumstances such as weather events or labor strikes. This can cause a ripple effect throughout the supply chain, leading to delays and increased costs.

5. Integration risk

Integration risk is a crucial concern in supply chain finance. This refers to the risk associated with integrating various systems and processes used by different parties in the supply chain. For example, a supplier may use one system to manage their invoices, while a buyer uses an entirely different system to process payments. In such cases, integrating these systems can be a significant challenge, leading to errors and delays.

To mitigate integration risk, companies can use technology platforms that offer standardized interfaces for all parties involved in the supply chain. These platforms can help automate various aspects of the supply chain finance process, reducing the risk of errors and delays.

In conclusion, supply chain finance presents several challenges and risks that companies need to address to ensure their programs’ success. Companies that are successful in managing these challenges and risks can reap significant benefits in terms of improved operational efficiency and increased cash flow.